SolarWind Corporation

Not an Energy Company but a capital light IT monitoring Corp Worth its Weight

Thank you for reading The Genius’ Stock Market Newsletter. I rely solely on reader support exclusively, so if you enjoy my writing, or learn something new from it, please consider a paid subscription.

So, I recently updated my stock screener, which still included my recent Generals write up idea 👇🏾🦾👇🏾

Shutterstock Inc

TL;DR Enter at $33 (1.2 B market cap). $SSTK’s significant subscriber base offers downside protection with an estimated intrinsic value of $65, representing an upside 24% 3yr cagr for 2027.The Genius’s Stock Market Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

This indicates that we’re on the right track in our “mens era”. Another generals’ idea is SolarWinds Corporation (SWI 0.00%↑).

Let’s dig in to some notes!

Check the 3-month trading chart. The stock trades above the volume weight mean price of $13.17, exceeding our “15% trading rule” but still in the green. If it retraces, we’ll be stronger buyers. But if it breaks below $12.88 until it settles, we’ll be net sellers. Something extraordinary must happen to convince us to buy.

Investment Thesis

SolarWinds Corporation (SWI 0.00%↑) is a great around $14.22. The stock is undervalued and could significantly increase. We believe it could reach $28 per share, a substantial difference from its current value. Similar deals have been successful, and there’s a chance someone will buy SolarWinds for a high price. Even if not, the company is thriving and transitioning to a subscription model, ensuring long-term profitability. We predict $1.1 to $1.2 billion in revenue by 2027.

Our analysis offers a unique perspective on SolarWinds’ future. We highlight the shift from a one-time purchase model to a subscription model, which boosts revenue per customer. We also believe SolarWinds’ move to a unified observability platform is a game-changer, but the market hasn’t fully recognized its potential. Additionally, the company’s high private equity ownership makes an acquisition likely, not fully reflected in the stock price. Recent financial results show strong performance, including 6% year-over-year revenue growth in Q3 2024, a 48% adjusted EBITDA margin, and a 36% year-over-year growth in subscription ARR. Notably, the company reported a net income of $12.6 million in Q3 2024. This performance aligns with our investment idea and addresses key points about change, drivers, catalysts, conviction, and profitability.

While acknowledging potential risks, let’s remember the uncertain future. Cyberattacks pose a real threat, eroding customer trust and incurring financial losses. The ongoing SEC lawsuit adds to these risks. Switching to a subscription model could slow revenue growth amidst increased competition and potential market share loss. Economic factors and other challenges could further hinder growth. A severe scenario involving a new cyberattack, stalled transition, more competition, recession, leadership changes, or failed acquisitions could lead to a 50% drop in the stock price.

The market overlooks crucial aspects. It may underestimate acquisition chances due to private equity investments. It also fails to grasp SolarWinds’ transformation into a comprehensive observability and IT management solutions provider. This new platform has significantly boosted the company’s value and long-term prospects. The market should recognize SolarWinds’ progress and success beyond the subscription model. Past problems like the 2020 cyber incident and the SEC investigation should be ignored in favor of the company’s current positive direction.

The price-to-intrinsic-value gap is likely to close due to an acquisition offer from a strategic buyer or private equity firm. Continued growth in subscription revenue and ARR, platform adoption, and improving investor sentiment will also increase the market’s perception of the company’s true worth. As analysts and investors learn about SolarWinds’ strong financials and transformation, the stock will attract more attention, narrowing the gap.

Increased awareness will come from earnings reports, investor presentations, industry publications, and analyst coverage. Industry recognition and M&A speculation will further draw attention. Positive customer and partner experiences will enhance awareness.

Concluding SWI 0.00%↑ offers a compelling investment opportunity due to its strategic position, strong recurring revenue, and the potential for an M&A event. The current market valuation appears to be missing key elements of the company's transformation and future potential. As the company executes its strategic plan and positive results continue, the gap between price and intrinsic value is likely to close. While risks exist, the potential rewards justify the investment.

Potential Catalysts

SEC investigation conclusion

Merger/Acquisition deal

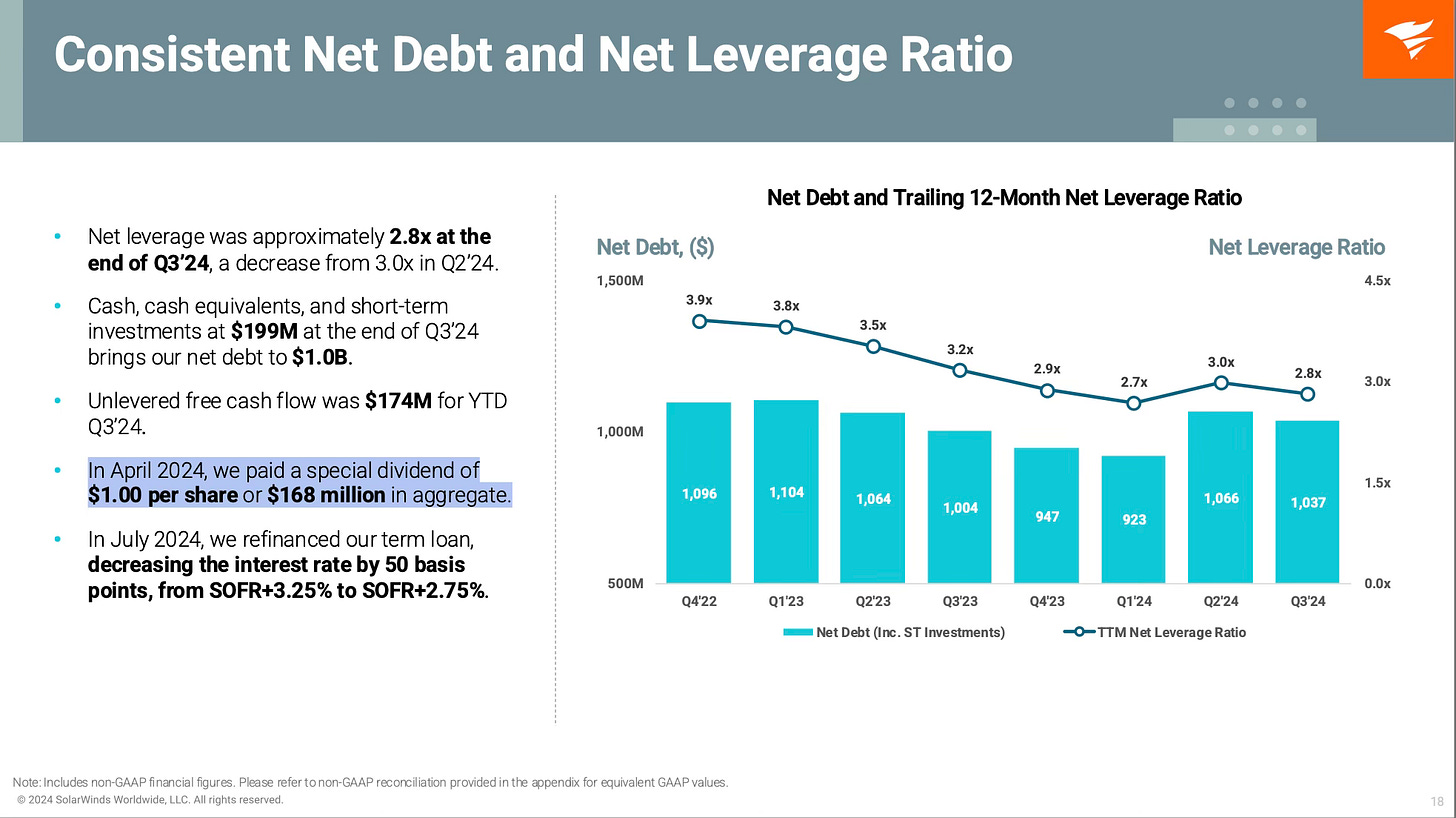

Debt reduction

Dividend distribution - sort of an aside but the company issued a dividend when its net leverage ratio reached 3x EBITDA

Who is Solarwinds Corporation?

I’m curious, are they actually a wind/energy company? It seems a bit odd to call yourself SolarWinds without being in the energy industry with that name.

Lets not belabor the point. We’re here to make money.

SWI 0.00%↑ is an American company that develops software for businesses to help manage their networks, systems, and information technology infrastructure.1

Essentially their2:

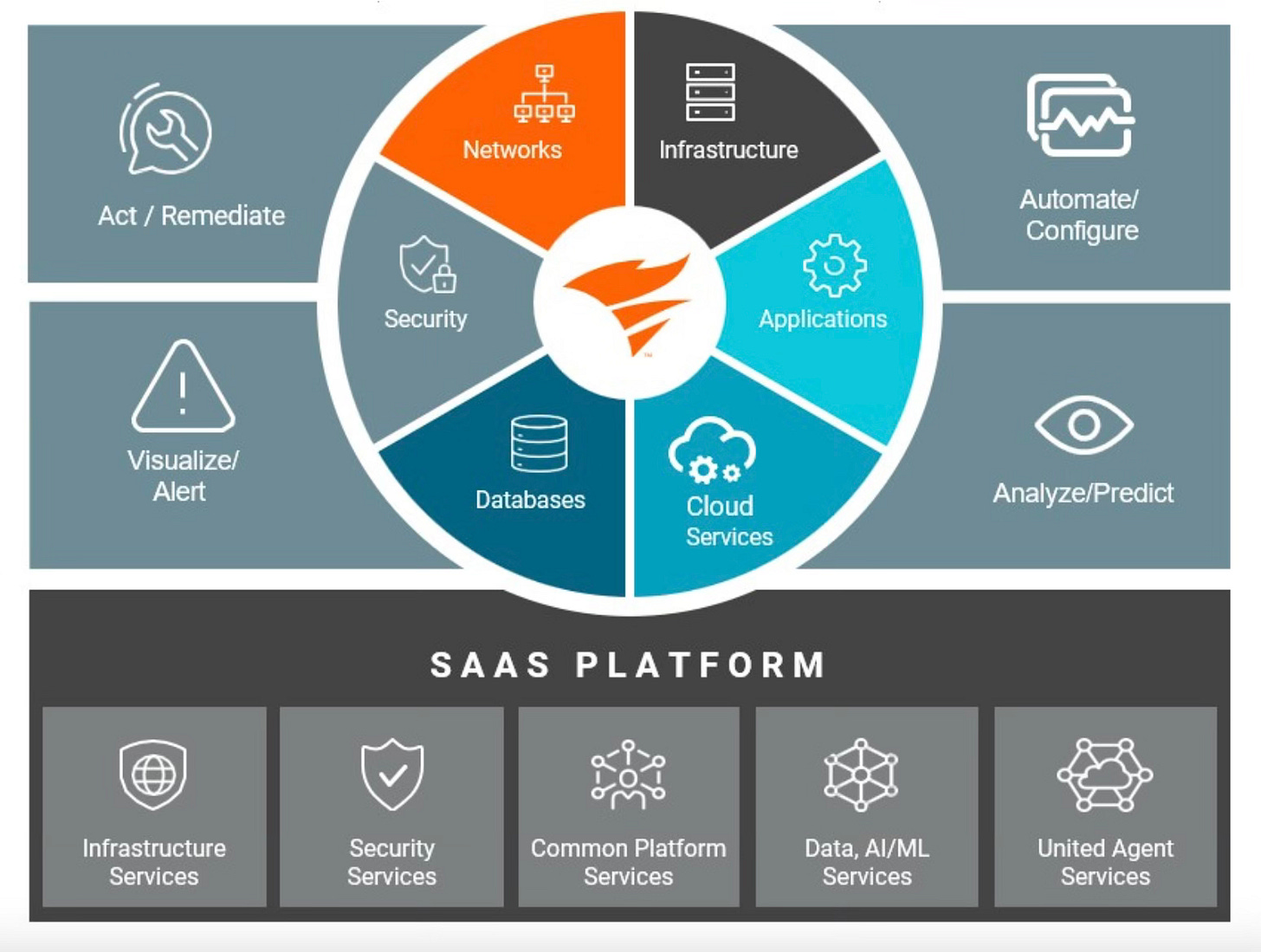

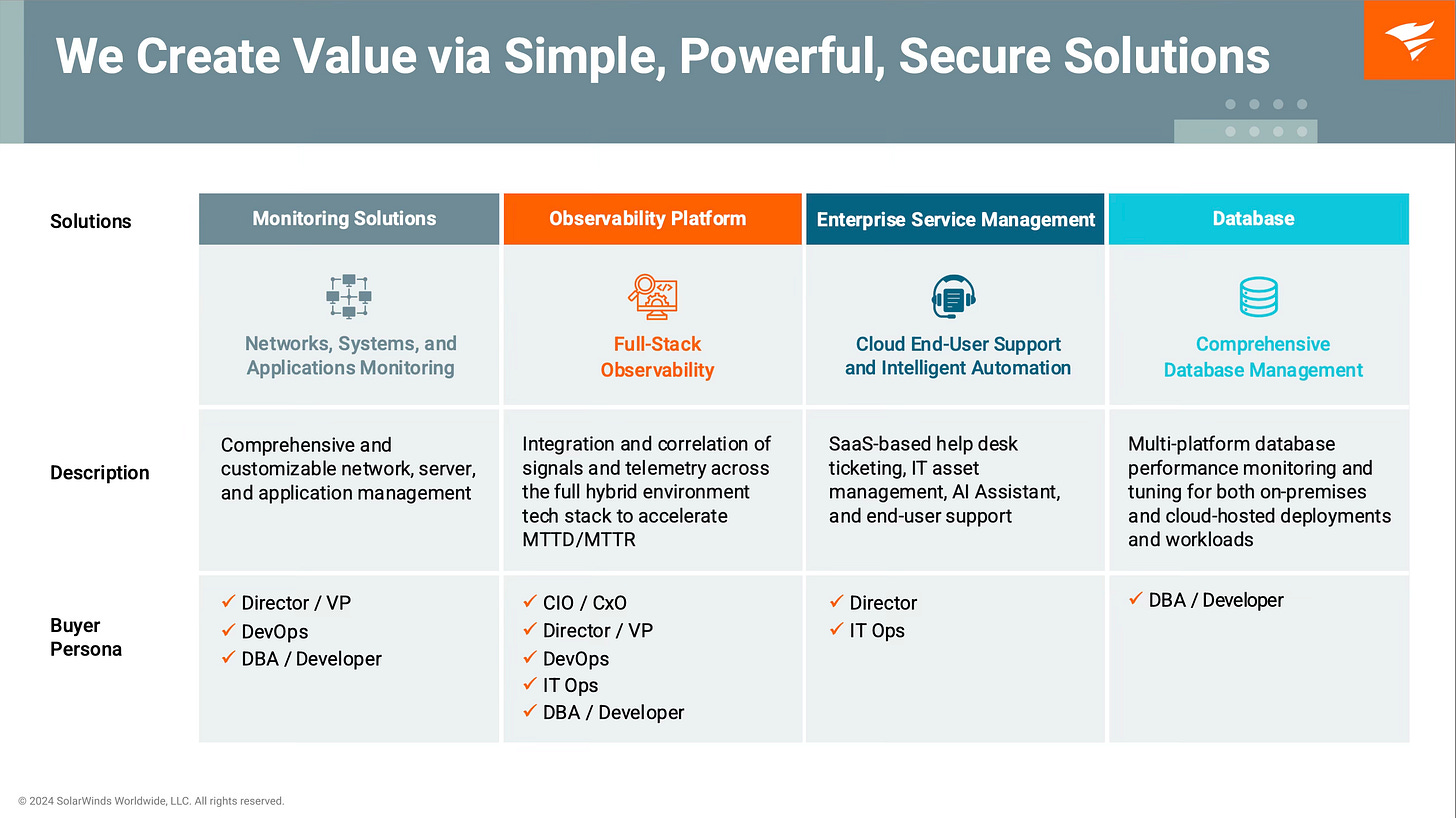

Focus: Provide a suite of IT management software that includes system management, network management, database management, IT security, IT service management & application management.

Key Features: Help organizations monitor & analyze the performance of their IT environments, whether on-premises, in the cloud, or in hybrid deployments.

Goal: Provide simple, powerful, and secure solutions that accelerate business transformation.

In simpler terms: Imagine SolarWinds as a set of tools that IT professionals use to keep their company's technology running smoothly. These tools help them understand how their networks are performing, identify and fix problems quickly, and ensure everything is secure.3

What is “Observability” in IT?

I will have to admit this is where Artificial Intelligence comes to play in further understanding the Industry SWI 0.00%↑ operates. There is plenty of mention on observability in researching the company so I thought it appropriate to add the below:

In IT performance, "observability" refers to the ability to understand the internal state of a system by collecting and analyzing data like logs, metrics, and traces, allowing you to monitor and diagnose performance issues by seeing how different components within a system are interacting and performing, essentially giving you a comprehensive view of your system's health and behavior in real-time.45678 [1a, 2a, 3a, 4a, 5a]

Three pillars: Logs (detailed event records), metrics (numerical measurements like CPU usage), and traces (tracking a request across multiple services) are the core data points used to achieve observability. [1a, 4a, 5a]

Beyond monitoring: While monitoring is collecting data, observability goes further by analyzing that data to identify root causes of performance issues and understand complex system interactions. [1a, 3a, 6a9]

Generative AI is experimental.

Observability regarding SolarWinds Corporation SWI 0.00%↑

In the context of SolarWinds Corporation SWI 0.00%↑, "observability" refers to a comprehensive Information Technology(IT) performance monitoring solution that provides deep insights into the health and performance of an entire IT infrastructure, including applications, networks, servers, and databases, by collecting and correlating data across various sources, allowing for proactive problem identification and faster troubleshooting, essentially giving IT teams a holistic view of their system's behavior and potential issues through automated analytics and intelligent insights. [1b12, 2b13, 3b14, 4b15]

Key points about SWI 0.00%↑ observability: [1b, 2b, 5b16]

Full-stack monitoring: Captures data from various components of the IT environment, including web applications, services, cloud infrastructure, databases, and networks. [1b, 2b, 5b]

Data correlation: Connects data points from different sources to identify patterns and relationships, providing a deeper understanding of system behavior. [1b, 6b17, 7b18]

Actionable insights: Uses machine learning and AI to analyze data and generate alerts for potential problems, allowing for proactive issue resolution. [1b, 3b, 6b]

Hybrid cloud support: Monitors both on-premises and cloud-based systems, providing unified visibility across diverse environments. [1b, 4b, 8b19]

Smart automation: Automates response actions based on identified issues, reducing manual intervention. [1b, 3b, 5b]

Generative AI is experimental.

SolarWinds: From Network Monitoring to Full-Stack Observability

SolarWinds Corporation was started in 1999 in Tulsa, Oklahoma, by Donald and David Yonce. They began by making network monitoring software. Early products like Trace Route and Ping Sweep (which came out in 1998, before the official start) were their first. The name “SolarWinds” meant “natural, powerful, and dynamic forces,” which matched what they wanted to be when they started. From the beginning, SolarWinds has been about giving IT professionals useful tools, and that’s still what they do today. Its history can be summarized by key phases:

Key Historical Phases:

Early Growth and Expansion (1998-2009): SolarWinds quickly established itself in the network monitoring space. The 2001 launch of its first web-based network performance monitoring application marked a significant step. The company maintained profitability throughout this period, culminating in its initial public offering (IPO) in May 2009, which raised $112.5 million. In 2006, the company relocated its headquarters to Austin, Texas.

Public and Private Ownership (2009-2018): Following its successful IPO, SolarWinds operated as a public company until 2015, when private equity firms Silver Lake Partners and Thoma Bravo acquired it for $4.5 billion, taking it private in January 2016. The company returned to the public market in October 2018. This period highlights the company’s increasing value and attractiveness to investors.

Transformation and Strategic Shift (2018-Present):

This phase has been marked by significant changes:

Leadership and Restructuring: Kevin Thompson retired as CEO in December 2020 and was succeeded by Sudhakar Ramakrishna in January 2021. In July 2021, SolarWinds strategically spun off its Managed Service Provider (MSP) business into a separate public company, N-able, allowing SWI 0.00%↑ to focus on its core strengths.

The SUNBURST Cyberattack (2020): A major cybersecurity incident, known as the SUNBURST attack, significantly impacted SolarWinds in December 2020. This breach, which affected its Orion software, led to substantial financial and reputational damage, including a class-action lawsuit and SEC enforcement action. This event became a catalyst for significant changes within the company.

Focus on Observability: In response to the attack and evolving market demands, SWI 0.00%↑ shifted its strategic focus towards observability. This transition aims to provide comprehensive visibility across modern, distributed, and hybrid IT environments. The company has rebranded its offerings as "SolarWinds Observability," available in both self-hosted and SaaS models.

With the “Who & What” out of the Way →Financials🏦

As Bruce Greenwald and Robert Cassandro perceive analyzing financials through a modern day Graham&Dodd approach. I will attempt a look at SWI 0.00%↑ as they would have done in their books.

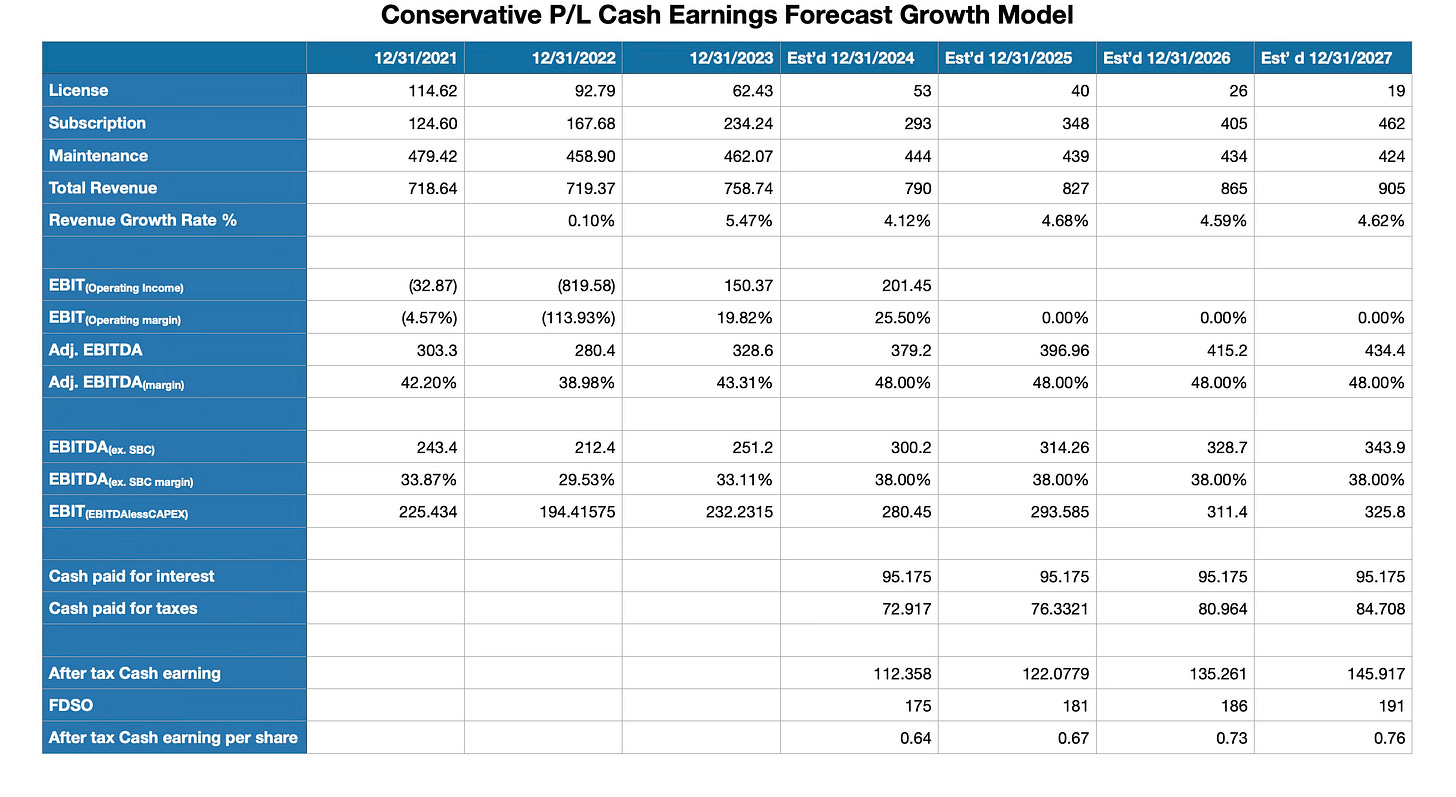

Our projected estimates for SolarWinds Corporation's annual revenue for 2027 is based on a few factors: historical performance, industry trends, market conditions, and the company's strategic initiatives. Here’s our analysis to provide a well-informed projection:

Historical Performance

2019: Total Revenue $932.5 million (before adjusting for 2021 N-able spinoff)

2020: Total Revenue $1,019.2 million (before adjusting for 2021 N-able spinoff)

2021: Total Revenue $718.6 million (impacted by the cyberattack)

2022: Total Revenue $719.4 million

2023: Total Revenue $758.7 million (estimated time of recovery)

TTM: Total Revenue $784.7 million

Industry Trends

IT Management Software Growth: The IT management software market is expected to grow at a CAGR of 8-10% from 2023 to 2027.

*Cybersecurity Focus: Increased investment in cybersecurity solutions post-2020 cyberattack could drive additional revenue streams.

Market Conditions

Economic Environment: Assuming a stable global economy with moderate growth.

Competitive Landscape: Continued competition from companies like ServiceNow, BMC, and IBM.

Strategic Initiatives

Product Innovation: Development of new features and integrations to enhance product offerings.

Market Expansion: Potential entry into new geographic markets or industry verticals.

Customer Retention: Focus on retaining existing customers through improved service and support.

Revenue Projection📊

Considering the above factors, a reasonable projection for SWI 0.00%↑'s annual revenue by the end of 2027 can be estimated as follows:

Base Case: Assuming steady growth and recovery from the cyberattack, revenue could grow at a CAGR of 7-9%.

2027 Revenue: $0.97 billion - $1.02 billion $32 valuation

Optimistic Case: If the company successfully innovates and expands its market presence, revenue could grow at a CAGR of 10-12%.

2027 Revenue: $1.08 billion - $1.14 billion

Conservative Case: If growth is slower due to market saturation or increased competition, revenue could grow at a CAGR of 5-6%.

2027 Revenue: $0.91 billion - $0.94 billion

SWI’s annual revenue by the end of 2027 is expected to be around **$1.1 - $1.2 billion**, assuming a steady recovery and growth. This estimate considers industry trends, market conditions, and the company’s strategic plans.

Valuations

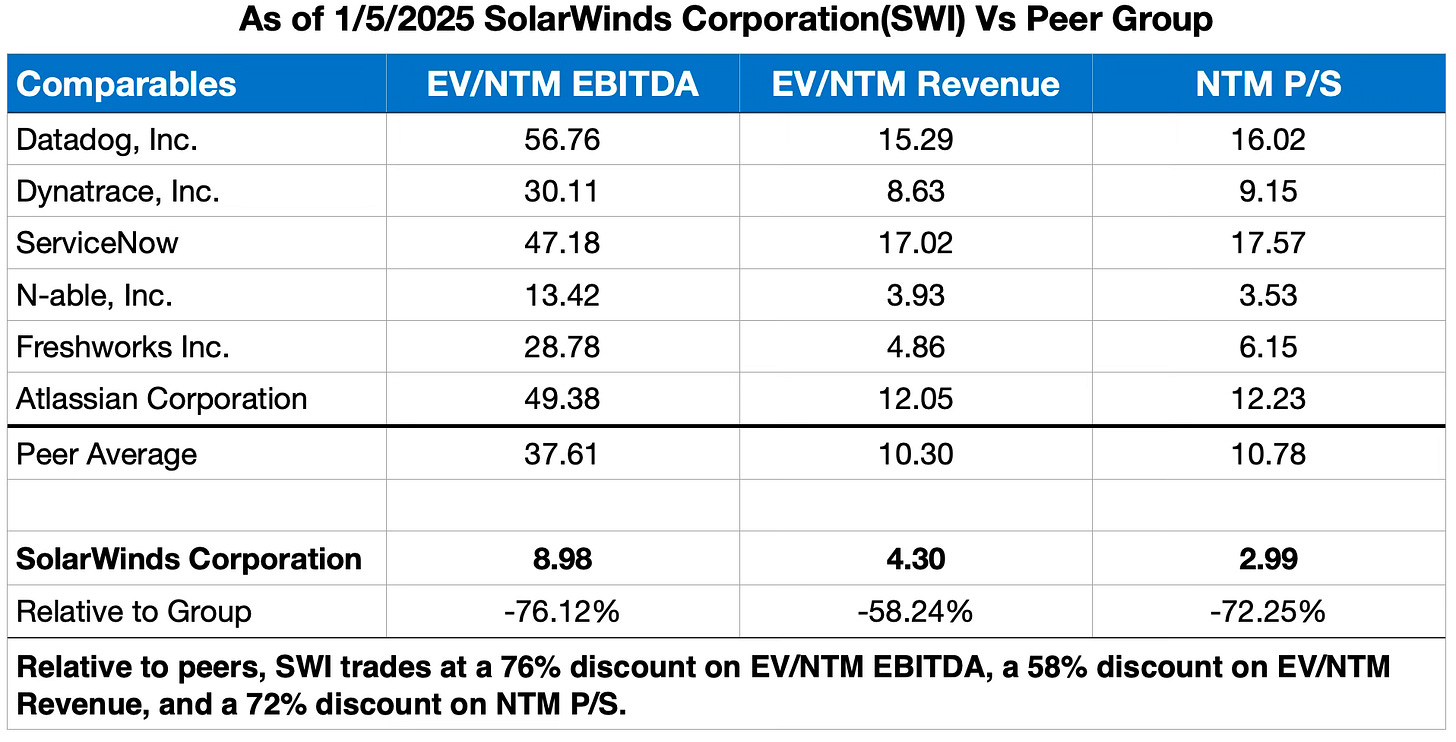

In this analysis, we’re exploring the potential value of SWI 0.00%↑ We’re examining various valuation methods based on revenue and EBITDA (earnings before interest, taxes, depreciation, and amortization). To do this, we compared SolarWinds to other tech companies that have recently been acquired. We anticipate that a strategic or private equity buyer might start with a conservative bid between $18 and $28 per share. Given SWI’s highly attractive M&A target, any offer could potentially spark a bidding war. Comparing the sale prices of companies like Datadog and Dynatrace, it appears that strategic buyers are paying a premium for SolarWinds.

Key Takeaways:

Revenue Multiples: Assuming a 5-12% growth rate in 2025 revenue, the EV/Revenue multiple could range from 3x to 9x.

EBITDA Multiples: Assuming an EBITDA margin of 44-48%, the EV/EBITDA multiple could range from 7x to 31x.

Recent deals like Cisco's acquisition of Splunk and Francisco Partners' purchase of New Relic demonstrate the premium valuations that technology companies can command. These transactions, with EV/Revenue multiples ranging from 5.16 to 7.1 and EV/EBITDA multiples from 14.1 to 30.9, provide valuable context for SolarWinds' valuation.

The valuation landscape is further influenced by the type of acquirer. Strategic acquirers, driven by synergies and long-term growth potential, often pay higher multiples than private equity firms, which prioritize financial returns and operational efficiencies.

This analysis provides a framework for understanding SWI's potential valuation based on current market trends, comparable transactions, relative peer group grounded in an analysis on an absolute value basis before M&A cost savings any acquirer would gain by purchasing SWI 0.00%↑. By considering both revenue and EBITDA multiples, along with the varying approaches of strategic and private equity acquirers, we can gain valuable insights into the company's future prospects.

Relative Valuation

Precedent Acquisitions

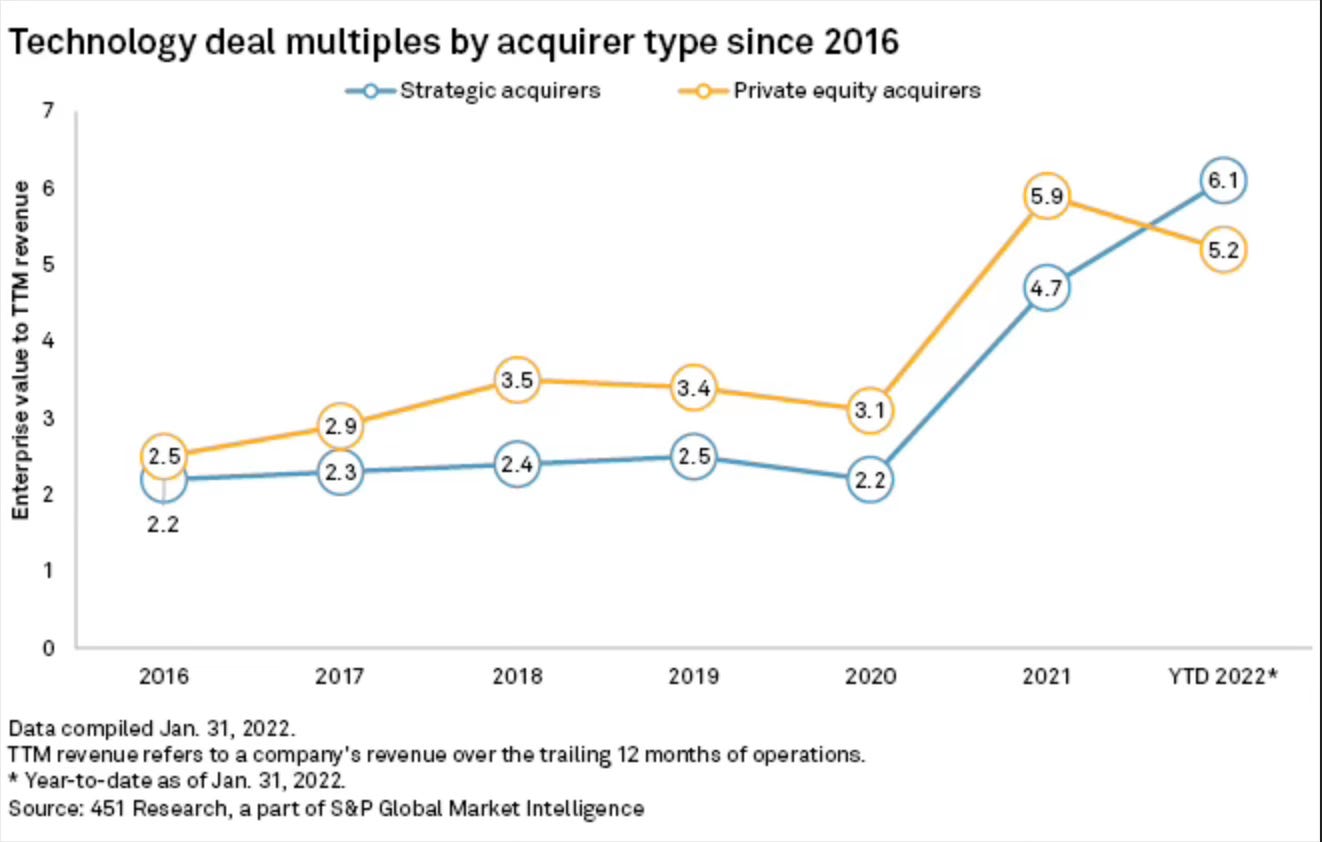

Presented above is a comparative analysis of technology deal multiples by acquirer type from 2016 to January 2022, based on enterprise value compared to trailing twelve months (TTM) revenue. Private equity acquirers generally maintained higher multiples compared to strategic acquirers throughout the period. In 2016, private equity acquirers had a multiple of 2.5, which peaked at 5.9 in 2021 before slightly declining to 5.2 YTD 2022. Strategic acquirers began at 2.2 in 2016, jumped to a multiple of 4.7 in 2021, and then surpassed private equity acquirers to 6.1 YTD 2022. The data suggests that strategic acquirers, likely driven by synergies and long-term growth potential, were willing to pay a premium for technology companies, which is reflected in their higher multiples. In contrast, private equity acquirers, focused on financial returns and operational efficiencies, tended to have higher multiples. This trend highlights the differing valuation approaches and investment strategies employed by strategic and private equity acquirers in the technology sector. The following are precedent transactions more comparable to SWI business operations:

Announced July 2023

Acquirer: Cisco Systems, Inc.

Target: Splunk Inc.: IT operations, security, and observability.

NTM Multiple: EV/Rev - 7.1; EV/EBITDA - 30.9

Announced July 2023

Acquirer: Francisco Partners Management, L.P. & TPG Fund

Target: New Relic, Inc.: Application performance monitoring (APM), observability, and cloud monitoring.

NTM Multiple: EV/Rev - 5.8; EV/EBITDA - 30.4

Announced Aug 2022

Acquirer: OpentText

Target: Micro Focus: IT operations management, network monitoring, and application performance management.

NTM Multiple: EV/Rev - 2.3; EV/EBITDA - 6.7

Announced Jan 2022

Acquirer: Elliott Investment Management L.P. & Vista Equity Partners Management, LLC

Target: Citrix Systems, Inc.

NTM Multiple: EV/Rev - 5.16; EV/EBITDA - 14.1

Premium valuation a moving target in $16.5B Citrix acquisition - Feb 2022

Announced Jun 2021

Acquirer: Kohlberg Kravis Roberts & Co. L.P. and Clayton, Dubilier & Rice, LLC

Target: Cloudera Inc.

NTM Multiple: EV/Rev - 5.2; EV/EBITDA - 30.4

Comparable Company Analysis

Absolute Valuation

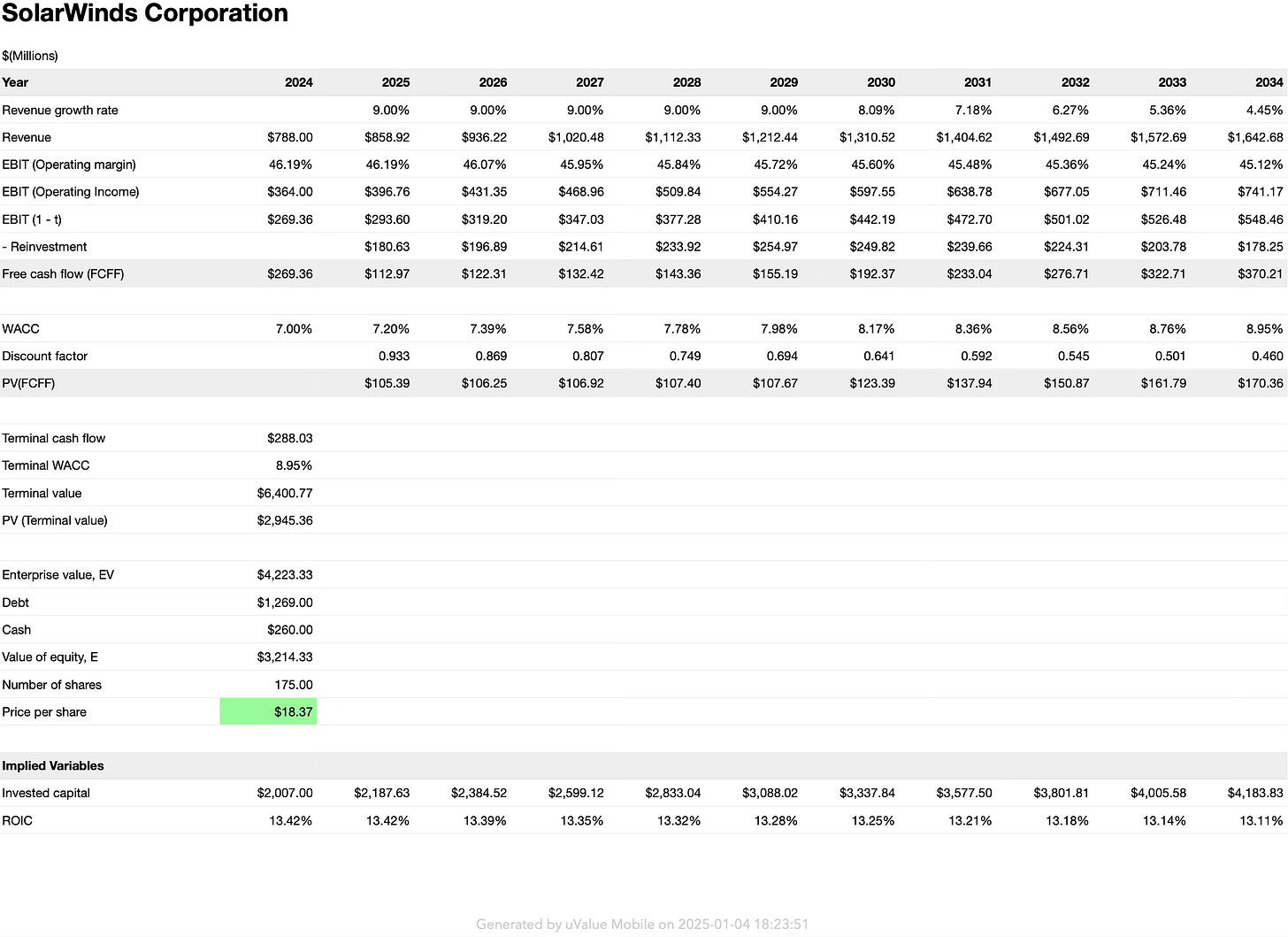

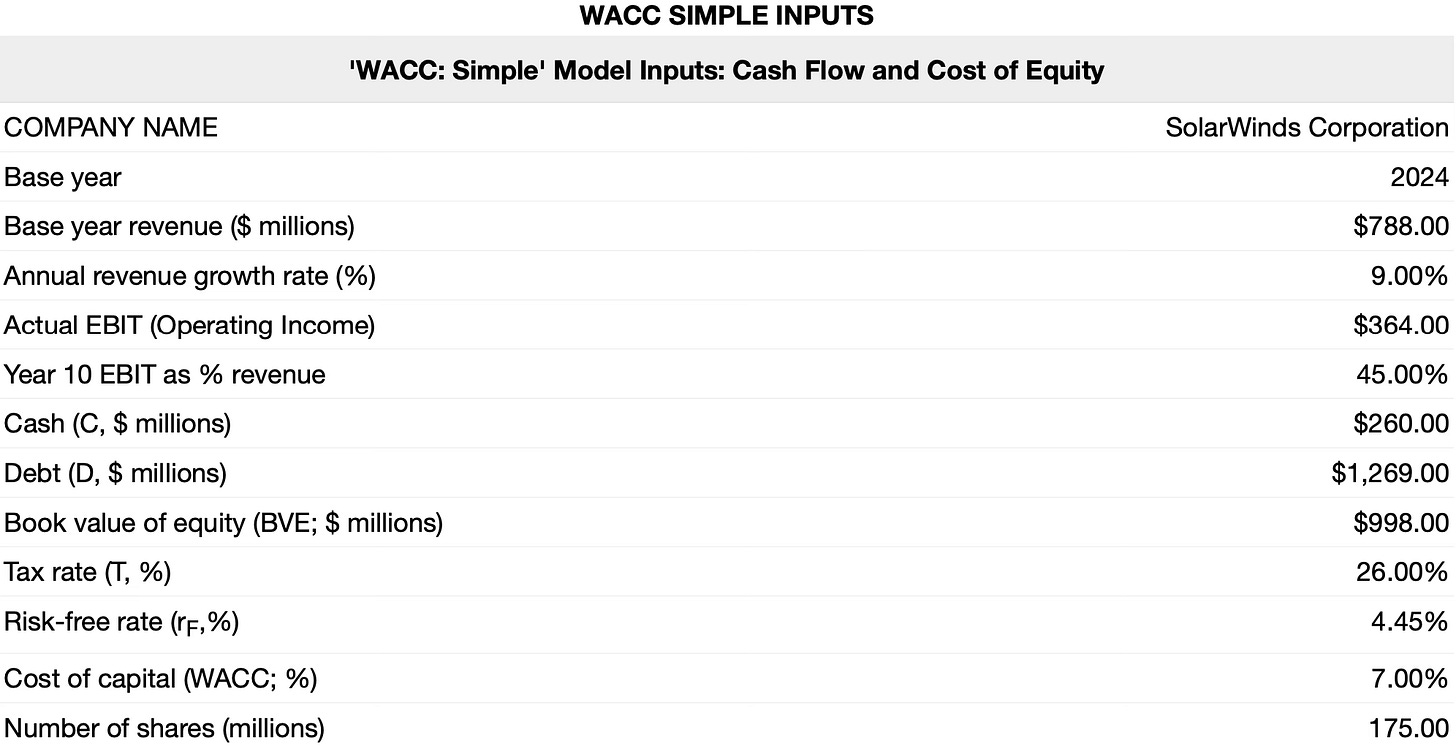

Discounted cash flow

Keys to Getting the Stock Right

Key Questions to Consider:

To further refine our variant perspective:

Is there an element of change and a clear path to getting paid? Yes, the transition to a subscription model and the development of a unified observability platform represent significant changes. There is a clear path to getting paid through increased recurring revenue and the potential for larger deals eventually increasing the intrinsic value.

How much does the thesis depend on internal or external factors? The thesis is heavily reliant on business operational execution (platform development, sales strategy) but also influenced by external factors like overall IT spending, cloud adoption and concentrated insider private equity shareholder base.

What are the catalysts; what are you playing for? Catalysts include continued subscription growth, successful adoption of their observability platform, and the ability to consolidate customer tools. You are playing for a company that is able to achieve higher revenue per customer, greater profitability, and sustained growth. We also have a highly motivated PE shareholders willing to sell the company at the right price.

How much of the thesis is internally driven by the company? The transition to a subscription model, product development and focus on the SolarWinds platform are all driven internally.

What is your conviction level? Based on the financial performance and the company's execution to this point, there is a strong case to be made about the company's future and conservative intrinsic value realization of at least $18 a share resulting in a +25% aggregate return.

How does your outlook differ from that of others? The market may be underestimating the potential for margin expansion as management has guided in early 2024 an EBITDA margin of mid 40s. Market may also be questioning the impact of platform maturity and the strength of customer retention.

What is the upside/downside probability of getting fundamentals right? The upside lies in the company's ability to execute its strategic plan and generate consistent growth. The downside could stem from slower than expected adoption of their platform, macro-economic issues, or increased competition.

What is the probability of getting paid if you are right? If the core assumptions about increased revenue per customer, margin expansion, and growth are correct, the probability of positive returns is high.

Has any sort of expectational analysis been done to gauge what is "in the stock"? This would require further research, but it is worth considering what the current stock price reflects about market sentiment.

Is this really an absolute-return call, or is this a relative-performance call? It appears that this is an absolute return call, based on the company's internal development and performance.

Should this idea be hedged? This depends on your personal risk tolerance and investment strategy.

Are there macro/sector risks that the analyst didn't consider? It's important to consider macroeconomic factors, potential impacts of the cyber incident, and the competitive landscape.

Could you actually lose even if your thesis is right? While unlikely, it is possible that unforeseen circumstances (such as further legal issues related to the cyberattack or a major economic downturn) could negatively impact the stock price even if the company performs as expected.

Risk Mitigation

Bear Case

The SolarWinds situation is concerning. They’re transitioning to a subscription model, but it faces challenges. Competitors may erode customer base and revenue. Cyber attacks could further harm customers and finances. Amidst economic uncertainty, growth prospects are uncertain. Investing in SolarWinds may not be prudent.

Premortem/Worst case scenario

Imagine 18 months from now, when SWI 0.00%↑ stock plummeted by 50%. Despite switching to a subscription model, expanding their platform, and staying ahead, factors went awry. A cyberattack stole customer data, eroded trust, and led to customer churn. The subscription switch faltered as customers resisted giving up old licenses. Competitors offered cheaper, better products, and SolarWinds’ sales strategy lagged. The global economic downturn reduced IT spending, causing existing customers to cut back, cancel subscriptions, and delay renewals. Legal battles and financial losses further strained the company. Leadership changes disrupted plans, and acquisitions slowed progress. Additionally, rule-breaking exacerbated the situation. Consequently, SolarWinds’ stock crashed.

But here’s the thing: if SWI 0.00%↑ can figure out what went wrong and fix it, they can make things right. They need to keep an eye on their performance and the industry, and be ready to change their plans if they need to. By doing this, they can avoid the same mistakes that led to their downfall and make a successful investment in SolarWinds.

Conclusion

SWI 0.00%↑ presents a compelling investment opportunity. Its strong recurring revenue, platform approach, and dominant position in the IT management software market position it for substantial growth. Several factors could drive up its stock price, including increased adoption of its subscription model, the success of its new AI initiatives, and resolution of any legal challenges.

The stock price could potentially range from $18 to $28 per share. With a potential acquisition, it could lead to even higher prices, potentially resulting in substantial profits for investors. While there are risks, such as increased competition and economic uncertainties, SolarWinds’ financial stability, substantial operational profits, strong market position, and potential for acquisition further mitigate these concerns. Additionally, the company’s commitment to research and development underscores its long-term growth prospects.

We believe the market has yet to fully comprehend the transformative changes and strategic plans underway at SolarWinds. This presents a unique opportunity for investors. The company’s financial strength, market dominance, and growth potential make it an attractive investment. By comprehending the reasons behind the stock’s undervaluation, investors can capitalize on this opportunity. Past problems and uncertainties may have led the market to overlook the company’s true strengths and future potential. Consequently, this presents an opportune time to invest in this rapidly evolving and promising technology company.