TL;DR

Enter SSTK 0.00%↑ at $33 (1.2 B market cap). $SSTK’s significant subscriber base offers downside protection with an estimated intrinsic value of $65, representing an upside 24% 3yr cagr for 2027.

Key Points:

What do they do

Connects brands w/content like images, footage, music, & 3D models. Offerings include licensing, metadata for machine learning(ml), distribution through Giphy, & content customization

Why undervalued

Negative market behavior sentiment of SSTK's traditional business model

Competitive pressures and disruption

Downside Risk/Protection

~470,000 subscriber base before Envato deal closure

Upside Potential

Envato deal adds 635,000 subscribers

Low capex DDS segment ignored by market

Why Invest Now?

Bouncing along historic lows back when customer & transaction count was significantly lower

Paying nothing for a lumpy but growing business segment of metadata services, content distribution services with newly acquired GIPHY in 2023

SSTK 0.00%↑ is a long. SSTK presents an intriguing investment opportunity worth approximately $65 a share fueled by its vast subscriber base, strategic investments in AI, and the burgeoning demand for ML & AI training data. However, short sellers are weighing challenges like customer attrition, fierce competition, and pricing pressures

Here is a deep dive autogenerated conversation about Shutterstock Inc.:

Executive Summary

One liner

Shutterstock is a long. SSTK presents an intriguing investment opportunity worth approximately $60 fueled by its vast subscriber base, strategic investments in AI, and the burgeoning demand for ML & AI training data. However, potential investors must weigh these strengths against challenges like customer attrition, fierce competition, and pricing pressures.

30 second Elevator Pitch Overview

Summary

Shutterstock Inc. (SSTK), a content creation platform known for its library of stock content, including images, footage, music, and 3D models, is at a critical juncture. Despite its strong brand presence and history of profitability, there are challenges to its long-term prospects.

The company’s recent acquisition has helped strengthen its subscriber base by 135% in the most recent quarter, solidifying its margin of safety. However, the stock trades at a relatively low price of 4.5x our 2025 EBITDA conservative estimate of $268M. Investors have not fully appreciated management’s commitment to multi-year revenue and EBITDA expansions for 2027 and quarterly cash dividends standing currently at an annualized yield of 3.8% on a stock price trading around $32 a share.

Despite its challenges, I remain optimistic about SSTK which presents an asymmetric payoff profile with the potential for a significant upside of at least 9 times our 2025 EBITDA base case estimate, resulting in a potential value of $65 per share. Conversely, in a downside scenario, the current stock price of $30 could potentially decline to 3 times our 2025 EBITDA, resulting in a value of $18 per share.

The stock content industry is becoming increasingly competitive, with established players like Adobe Stock, Getty Images, and disruptive newcomers like Canva challenging SSTK's market share. Additionally, the proliferation of free and low-cost stock content providers is exerting downward pressure on pricing, impacting SSTK's revenue growth and profitability. The rise of artificial intelligence (AI) presents both opportunities and threats. While SSTK has invested in AI capabilities, effectively integrating them into its offerings and navigating the ethical and legal complexities of AI-generated content will be crucial. This raises a critical question about the validity of investment recommendations, particularly questioning why one would consider SSTK as a viable investment when short-sellers have consistently proven correct while longs/bulls have been wrong in their assessments.

The central question for investors is whether SSTK can overcome these challenges and capitalize on emerging opportunities to achieve sustainable growth and profitability. This investment thesis argues that despite the headwinds, SSTK's strategic initiatives, particularly its focus on data, distribution, and services, coupled with its investments in AI, are a free valuation lunch, also adding in the non-subscription-based business. The analysis will draw upon SSTK's financial performance, strategic acquisitions, subscriber base, and its evolving competitive landscape to support this bullish outlook.

Potential Catalyst

New CFO Rikki Powell has a long career out of competitor GETY which will make for an interesting next three years

M&A possibilities potentially w/ Getty Images

Dividend payouts

Why is SSTK, Inc. Undervalued?

Behavioral, Competition, Growth Uncertainty

Market Behavior of SSTK's Traditional Business Model:

Commoditized Industry and Competition: Some investors may perceive the stock image and video industry as commoditized and highly competitive, leading to concerns about pricing pressure and limited growth potential. The presence of free players like Canva and Adobe Stock adds to this perception.

Focus on Mid-Tier Offerings: SSTK is perceived as being stuck in the middle ground, facing competition from both premium content providers and free offerings. This positioning raises concerns about its ability to maintain market share and pricing power.

Concerns about Financial Metrics:

Poor Free Cash Flow Conversion: A short-seller argues that SSTK's free cash flow conversion from EBITDA is poor, making the EV/EBITDA valuation appear deceptively cheap. This argument suggests that investors may be overlooking the company's actual cash-generating abilities.

Competitive Pressures and Disruption:

Threat from Adobe: Adobe's dominance in the creative software market and its growing stock business pose a significant threat to SSTK, particularly in the enterprise segment. Investors might be concerned about Adobe's ability to leverage its existing customer relationships and integrated offerings to gain market share.

Impact of AI and Disruptive Technologies: The emergence of AI-generated content and platforms like Canva could disrupt the traditional stock content market, potentially impacting SSTK's pricing power and long-term growth prospects. Investors may be uncertain about SSTK's ability to adapt to these technological shifts.

Sector Rotation:

Shift Away from Growth Stocks: Investors may be rotating away from growth stocks towards value stocks, impacting companies like SSTK that have historically traded at higher multiples.

Company Overview & Industry Analysis

Operations

Shutterstock, Inc., a global creative stock content platform, offers a diverse range of digital assets, including images, footage, music, and 3D models. As one of the largest marketplaces for high-quality licensed photographs, videos, and music, Shutterstock caters to businesses, marketing agencies, and media organizations. Founded in 2003 by its current chairman, Jon Oringer, the platform boasts an impressive library of over 340 million images and more than 19 million footage clips.

Stock content finds applications in various contexts, such as social media, websites, digital and display advertising, email marketing, and print collaterals. Customers can conveniently purchase stock content through e-commerce (via self-service web properties) and enterprise channels.

In terms of competitors, Shutterstock faces challenges from Getty Images, Adobe, and a multitude of smaller vendors. However, the company’s competitive advantages lie in its network effect, superior search capabilities stemming from its vast library of stock content, flexible and cost-effective pricing, and a well-established reputation for delivering licensed, high-quality stock content.

Headquartered in New York City, Shutterstock has been publicly traded since 2012 and has consistently generated positive cash flow since its initial public offering. In Q1 2020, the Board initiated a quarterly cash dividend of $0.17 per share, which has since increased to $0.30 per share.

The company operates through two primary offerings:

Content: This is the original business. It accounts for the majority of $SSTK's revenue which involves licensing digital assets to customers, primarily for commercial purposes. Customers can access content through brands owned by Shutterstock, like Shutterstock, Pond5, TurboSquid, PremiumBeat, and Envato.

Data, Distribution, and Services(DDS): This is a growing segment for SSTK and its customers/subscribers who’s needs go beyond traditional content licensing:

Data: Licensing of metadata associated w/ SSTK's digital assets to train AI and machine learning models. This area has experienced significant growth, driven by increasing demand for high-quality training data for generative AI applications.

Distribution: Services from the company's Giphy platform (acquired in 2023 from Facebook,) which allows users to share GIFs in conversations and contextual advertising.

Services: Consists of Shutterstock Studios, a full-service creative production studio that develops customized content for brands and agencies.

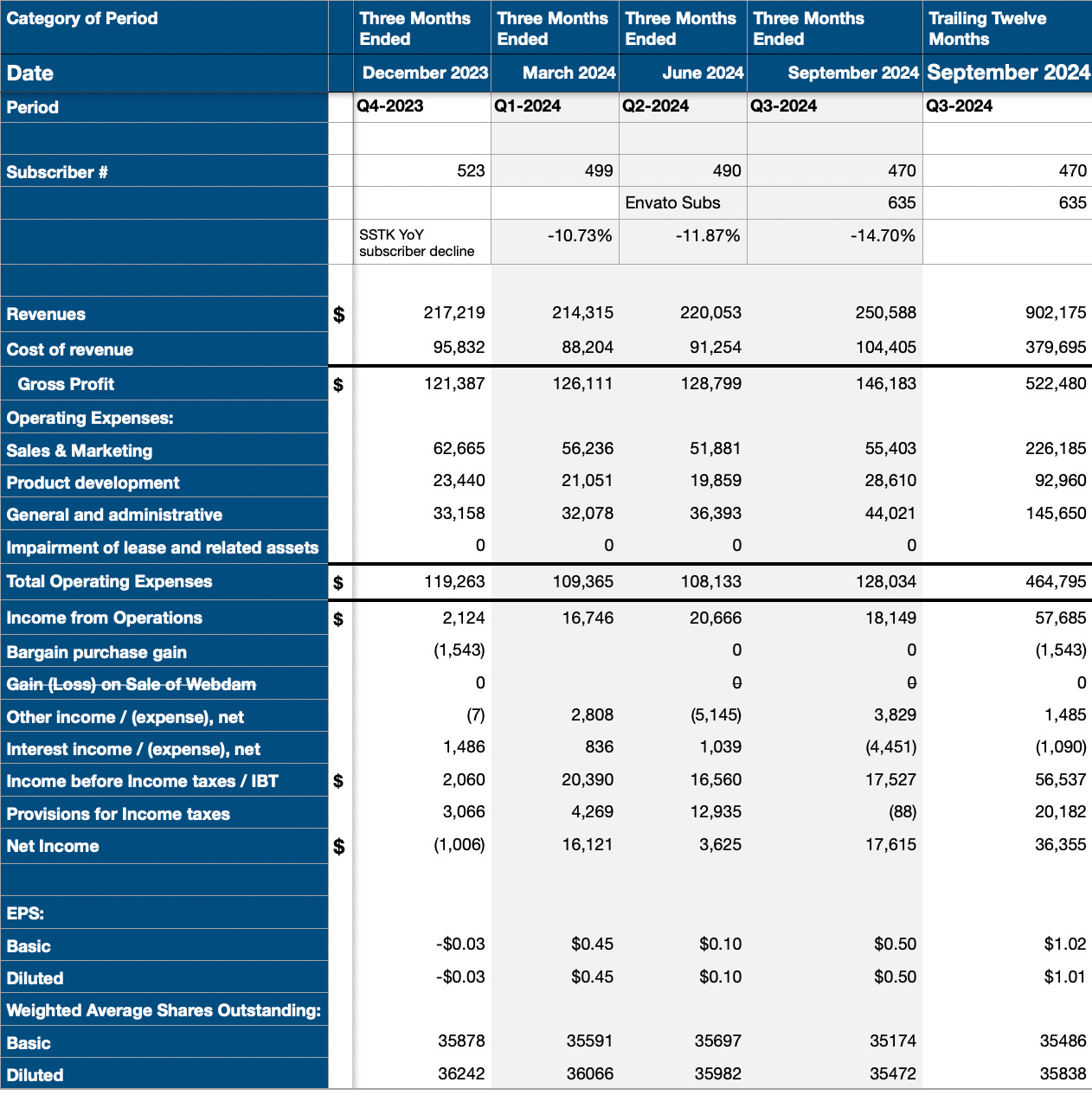

Based on information available through September 30, 2024, Shutterstock had generated $684.9 million in revenue and $242 million in adjusted EBITDA over the trailing nine months. The company has a market cap of $1.07 billion, net cash on hand, and significant free cash flow generation. Key shareholders include founder Jon Oringer, who holds a 33% stake. The company's Content business has experienced recent challenges, with revenue declining 7% year-over-year in the third quarter of 2024, excluding the contribution from Envato. However, the Data, Distribution, and Services segment is performing strongly, growing over 40% year-to-date.

Management's guidance for the full year 2024, which includes the contribution from Envato, is for revenue of $935 million to $940 million and adjusted EBITDA of $247 million to $250 million. For 2025 it's possible to consider some estimates based on existing information and industry trends. Based on the company's historical growth rates and stated long-term targets, a revenue estimate in the range of $1 billion to $1.05 billion for 2025 seems reasonable.

Estimated Adjusted EBITDA for 2025

Estimations can be made based on available information and some assumptions:

2024 Guidance: Guidance for 2024, with adjusted EBITDA projected to be between $247 million to $250 million, including approximately $9 million in M&A costs. This suggests an underlying adjusted EBITDA (excluding M&A costs) in the range of $238 million to $241 million for 2024.

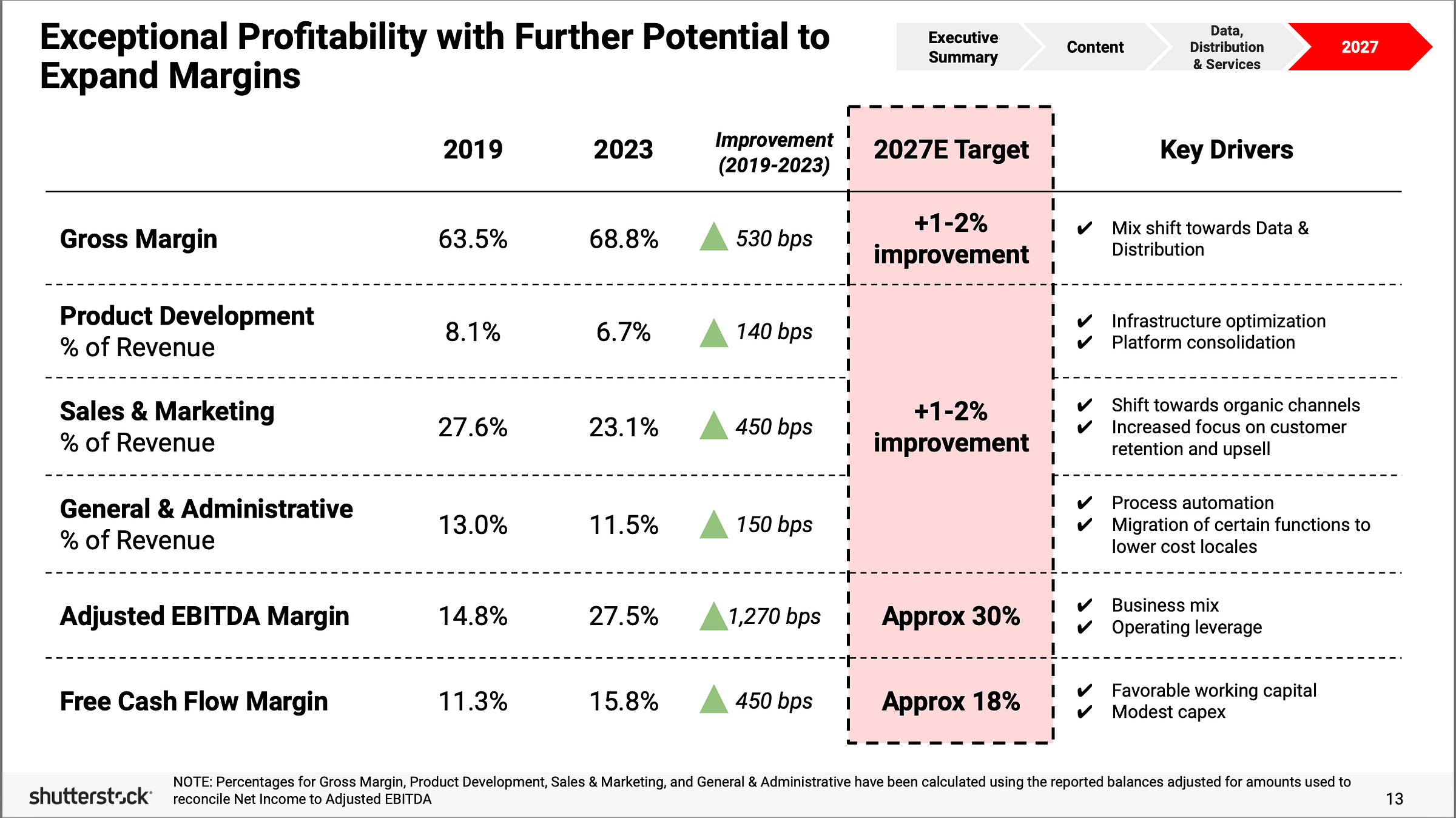

Long-Term Targets: Shutterstock aims to achieve $350 million in EBITDA by 2027. Assuming a linear progression, implies an annual EBITDA growth rate of roughly 12.5% from the midpoint of the 2024 guidance range.

Growth Drivers: The Data, Distribution, and Services segment is experiencing significant growth, with over 40% growth year-to-date in 2024. Though segment revenue is lumpy, continued success could be a major driver of EBITDA growth in 2025.

Content Segment Recovery: While the Content segment has experienced a decline in 2024, excluding Envato, the company expects gradual improvement and eventual return to growth.

Based on these factors and assuming a continuation of current trends, a reasonable estimate for adjusted EBITDA in 2025 could be in the range of $268 million to $276 million.

Operational Industry Addressable Market, Competitive Landscape & Future Expectation/Trends in the industry

Shutterstock's Vision for Expansion

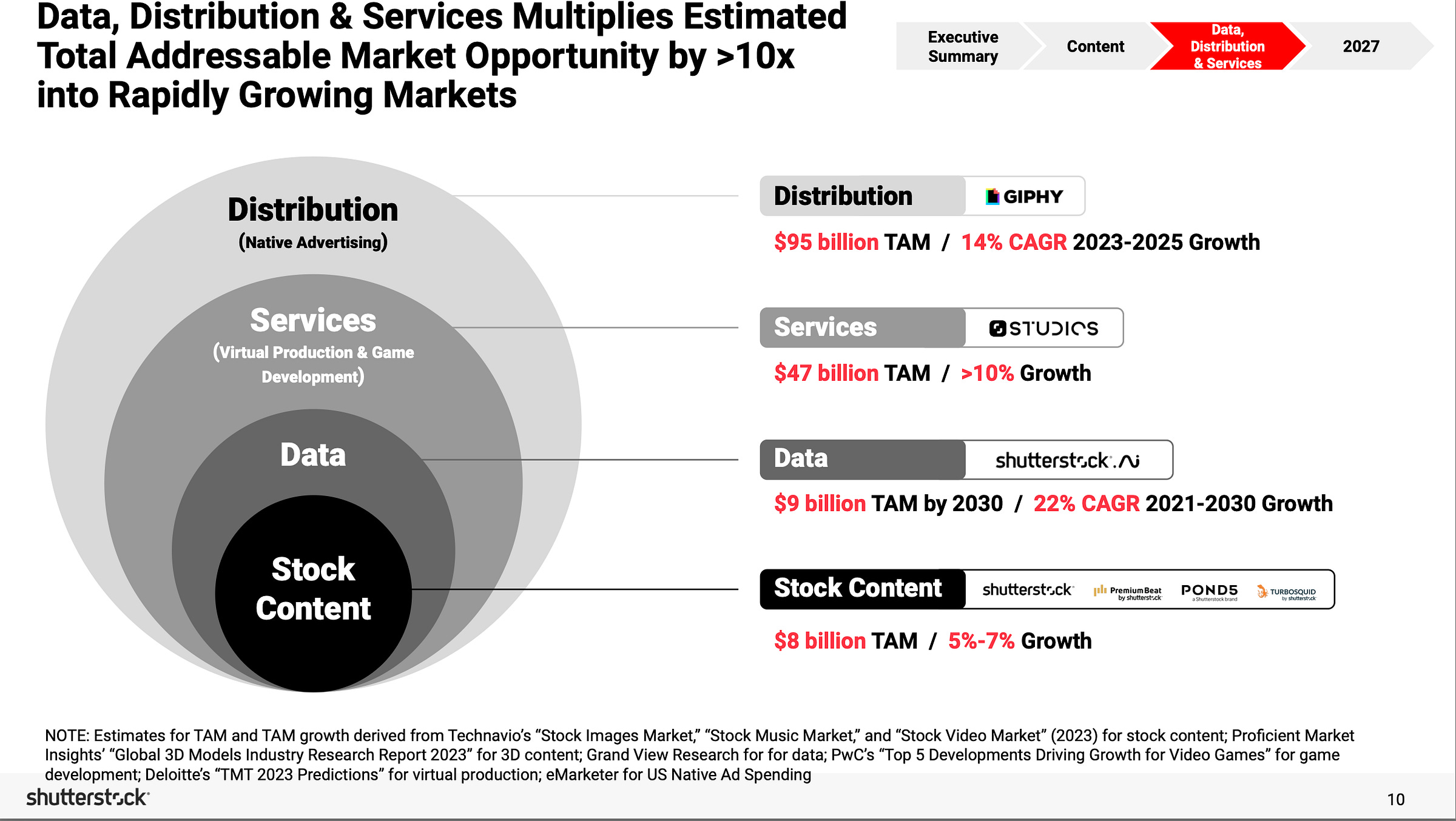

SSTK 0.00%↑ aims to significantly expand its market reach by diversifying its offerings beyond stock content. The company envisions a future where it's a major player in several rapidly growing markets:

Distribution (Native Advertising): Leveraging platforms like GIPHY, Shutterstock plans to dominate the native advertising space, a market projected to reach $95 billion by 2025 and growing at a 14% CAGR.

Services (Virtual Production & Game Development): Through STUDIOS, Shutterstock aims to cater to the booming virtual production and game development industries, a combined market estimated at $47 billion and growing at a double-digit rate.

Data: Recognizing the increasing value of data, Shutterstock is tapping into a market valued at $9 billion by 2030, growing at a 22% CAGR.

By expanding into these new areas while maintaining its core stock content business ($8 billion TAM, 5-7% growth), Shutterstock is positioning itself for substantial growth and a multiplied total addressable market opportunity.

Sustainable Competitive Advantage Analysis

SSTK 0.00%↑ doesn’t seem to have a significant competitive edge. To gain any such advantage, the company relies on its operating leverage to acquire neighboring competitors and streamline its current operational efficiency in the newly acquired companies. However, despite my skepticism, I believe SSTK has several potential advantages beyond just operating leverage and acquisition integration.

One advantage is SSTK's robust contributor network, which has been cultivated over its 17-year history. This network ensures a constant influx of fresh and relevant content. In combination with their proprietary tagging process, SSTK offers “one of the richest datasets in the marketplace,” a valuable asset in today’s AI-driven era.

Another advantage is SSTK's shift towards a subscription model, particularly in its enterprise offerings. This transition has provided recurring revenue and the potential for higher customer lifetime value, leading to more predictable and sustainable growth. However, the company has faced significant client attrition rates, which have increased from 10% year-over-year in December 2023 to 14% year-over-year in September 2024. Despite this, the content business still maintains strong operating leverage, which management has leveraged strategically through acquisitions like the recent Envato acquisition, which added 635,000 new subscribers, bringing the subscriber count from 470,000 to 1,105,000 at the end of September 2024.

Furthermore, SSTK maintains a robust financial position with strong free cash flow generation. This financial stability enables the company to invest in innovation, pursue acquisitions, and return capital to shareholders primarily through dividends of $1.20 per share, contributing to its long-term sustainability. With substantial working capital and strong free cash flow conversion and FCF margins ranging from 11% to 24%, and a 2027 guidance of 18%, SSTK's financial position is well-positioned for continued growth.

The continued growth will be driven by SSTK leveraging its extensive data and insights to differentiate its offerings and empower customers with tools to optimize their content selection and performance. Acquisitions like Pattern89, Datasine, and Shotzr significantly enhance this capability, enabling SSTK to provide predictive performance solutions that go beyond mere intuition and A/B testing.

SSTK.AI: Pattern89, Datasine, and Shotzr

These three companies were acquired by SSTK to form the foundation of SSTK.AI, focusing specifically on predictive performance. This means using data to predict how well a piece of content will perform before it's used in a marketing campaign.

Here's a breakdown of each company and its role within SSTK.AI:

Pattern89

Location: Indianapolis

Focus: Pattern89 provides a SaaS solution that helps customers analyze their past campaigns and use that data to predict future campaign performance, optimize media spending, and move away from relying on A/B testing or guesswork.

Analytics: Pattern89's analysis looks at a variety of visual elements, including colors, text sentiment, and the presence of people or specific objects.

Contribution to SSTK.AI: Pattern89 brings both the front-end user interface and the back-end data feeds for campaign analysis. It also provides SSTK with a strong team of product and tech talent.

Datasine

Location: London

Focus: Datasine specializes in machine learning and natural language processing, which are used to analyze and optimize the creative aspects of advertising.

Contribution to SSTK.AI: Datasine's back-end analytical capabilities complement Pattern89's front-end workflow. Datasine also expands the SSTK.AI team with its own talent in the tech and data science fields.

Shotzr

Location: Denver

Focus: Shotzr has built a large repository of survey data. This data is used to create proprietary audience models.

Contribution to SSTK.AI: Shotzr's audience models allow SSTK to generate "resonance scores," which predict how well a particular digital asset will perform with specific audience segments. Notably, Shotzr doesn't require customer-specific campaign data to make these predictions, which is especially valuable when working with new customers who don't have extensive campaign data.

Implementation and Impact

SSTK's plan is to integrate these predictive performance capabilities into its e-commerce and enterprise offerings over the next 6 to 12 months. This integration is expected to:

Address a Key Customer Pain Point: Provide data-driven recommendations to help customers confidently select content for their campaigns.

Improve Workflow Efficiency: Enable customers to test, analyze, and optimize their content within an intuitive workflow before deployment.

Increase Customer Retention: By delivering data-driven insights and improving performance, SSTK.AI has the potential to increase customer satisfaction and loyalty.

However, SSTK faces several challenges:

Competition from Free and Premium Offerings: SSTK faces competition from free stock image providers and premium platforms like Adobe Stock, particularly in the image segment.

Cannibalization of Traditional Content: Early data suggests that AI-generated content is complementary to traditional stock, but long-term trends are still uncertain. There’s a risk that AI content could eventually cannibalize sales of traditional content, especially if pricing strategies aren’t carefully managed.

Dependence on Acquisitions: SSTK's growth strategy heavily relies on acquisitions. Integrating acquired companies effectively and achieving desired returns on investment is crucial for sustained success.

Despite these challenges, SSTK's combination of a vast content library, an established contributor network, early adoption of generative AI, expansion into high-growth markets, and a focus on data-driven insights provides a foundation for sustainable competitive advantage. However, addressing competition, potential cannibalization, and the reliance on acquisitions are essential for long-term success.

Key Stakeholders

Board of Director influence, compensation committee, Executive Chair/CFO

Board of Director Influence

Compensation Committee: This committee plays a pivotal role in shaping the relationship between the Board and the executive team. Its members, as of 2024, are Deirdre Bigley (Chairwoman), Rachna Bhasin, and Thomas R. Evans. Notably, none of these individuals are part of the executive team, ensuring a degree of independence in evaluating executive compensation and performance.

Executive Chairman: Jonathan Oringer, the company founder, serves as Executive Chairman, a position with significant influence on both the Board and the executive leadership. He works closely with the CEO, Paul Hennessy, providing advice, participating in strategic planning, and driving key business relationships. This close collaboration suggests a potential alignment of vision and priorities between the Board Chair and the CEO.

Evaluating Jon Oringer's Potential Impact on SSTK's Future

A comprehensive view of Jon Oringer's journey as SSTK's founder, CEO, and now Executive Chairman. We highlight his entrepreneurial spirit, his deep understanding of the stock content market, and his ongoing influence within the company. His transition to Executive Chairman, coupled with his significant ownership stake, suggests that he's strategically positioned to advise on both stabilizing the stock content segment and driving the growth of the DDS (Data, Distribution, and Services) segment.

Oringer's Entrepreneurial DNA and Strategic Vision

History of Building Businesses Oringer's consistent success in creating and growing multiple businesses, starting with one of the earliest pop-up blockers and culminating in SSTK, speaks volumes about his entrepreneurial acumen and ability to spot market needs. This experience provides a strong foundation for understanding the challenges and opportunities associated with building and scaling new ventures, including the DDS segment.

Recognizing Market Gaps: Oringer's personal frustration with finding affordable stock photos led him to create SSTK, a testament to his ability to identify market gaps and create solutions that address those needs. This strategic insight is invaluable as SSTK navigates a rapidly evolving landscape with the emergence of generative AI and the growing demand for data and distribution services.

Shifting Focus from Operations to Strategy: His transition from CEO to Executive Chairman reflects a deliberate choice to focus on broader strategic guidance rather than day-to-day operations. This shift allows him to leverage his experience and insights to advise the company on a higher level, including setting the long-term vision for both the stock content and DDS segments.

Oringer's Potential Impact on the Stock Content Segment

Understanding Customer Pain Points: Oringer's intimate knowledge of the stock content market, stemming from his personal experience as a photographer and his founding of SSTK, positions him to advise effectively on addressing the challenges facing the segment. He can provide valuable input on pricing strategies, product offerings, and initiatives to improve customer acquisition and retention, as highlighted in source.

Navigating the Generative AI Landscape: While the sources don't explicitly mention Oringer's views on generative AI, his technical background suggests an awareness of this technology's potential impact on the stock content industry. He can help SSTK strategize on incorporating generative AI tools, like those mentioned in sources, into their offerings to enhance the value proposition for existing customers and attract new ones.

Oringer's Potential Influence on the DDS Segment

Guiding Strategic Investments: Oringer's role as Executive Chairman includes participation in strategic planning and discussions on capital allocation. This involvement suggests that he can influence SSTK's investments in the DDS segment, leveraging his understanding of market trends and emerging technologies to guide the company's resource allocation.

Leveraging Relationships and Experience: Oringer's long tenure in the technology and creative industries likely provides him with valuable relationships and insights that can benefit the DDS segment. He can potentially leverage these connections to forge strategic partnerships, similar to those mentioned in sources, and guide the company's expansion into new markets and customer segments.

Mentoring Leadership and Fostering Innovation: Oringer's experience as a successful entrepreneur can be a valuable asset in mentoring the leadership team responsible for executing the DDS strategy. He can provide guidance on navigating the challenges of building new businesses, fostering a culture of innovation, and adapting to the rapid pace of change in the technology and data markets.

Potential Concerns and Considerations

Maintaining a Balance of Power: One potential concern is ensuring a clear division of responsibilities between Oringer, as Executive Chairman, and the current CEO, Paul Hennessy. Oringer's strong personality and deep involvement could potentially create friction or hinder the CEO's ability to lead effectively. Striking the right balance between guidance and execution is crucial.

Adapting to Evolving Leadership Needs: As the DDS segment grows and matures, SSTK may require different leadership skills and expertise to navigate this new landscape. The Board should consider whether Oringer's strengths continue to align with the company's evolving needs or whether a transition to a different leadership structure might be necessary in the future.

Conclusion: A Blend of Experience and Strategic Vision

Jon Oringer's combination of entrepreneurial drive, technical knowledge, and deep understanding of the creative market makes him a valuable asset as Executive Chairman, particularly as SSTK seeks to stabilize its stock content segment and capitalize on the growth opportunities within the DDS segment. However, it's essential for the Board and leadership team to ensure a clear delineation of responsibilities and adapt to the evolving leadership needs of the company as it ventures into new and rapidly changing markets.

New Chief Financial Officer: Rik Powell

Background and Experience

Deep Industry Knowledge: Powell brings extensive experience in the digital media and image licensing industry, having spent 16 years at Getty Images, culminating in a three-year stint as their CFO. This background suggests a strong understanding of SSTK's core business and the competitive dynamics within the sector.

Public Company Experience: His time as SVP, Finance and Investor Relations at Shake Shack, a publicly traded company, provides valuable experience in financial reporting, investor relations, and navigating the demands of public markets.

Rapid Transition to CFO Role: Notably, Powell transitioned from SVP, Finance and Investor Relations to CFO within just a few months of joining SSTK. This swift promotion signals a high level of confidence from SSTK's leadership in Powell's capabilities and his ability to quickly grasp the complexities of the company's financials.

Potential Implications for SSTK

Content Business Focus: Given Powell's prior experience at Getty Images, a company heavily focused on content licensing, he might bring a renewed emphasis on improving the performance of SSTK's Content segment. This is an area that SSTK has identified as needing improvement, and Powell's expertise could be instrumental in driving its turnaround.

Financial Discipline and Growth: The sources suggest that SSTK is aiming to balance profitability with investments in growth areas like Data, Distribution, and Services. Powell's experience in both growing a public company (Shake Shack) and managing a mature content business (Getty Images) might position him well to execute this balanced approach.

Compensation and Incentives

Competitive Compensation: Powell's annual base salary is $450,000 and potential bonus of 80% of his base salary.

Performance-Based Equity: The grant of restricted stock units tied to the company's stock price further aligns Powell's incentives with the performance of SSTK's stock. This structure motivates him to make decisions that enhance shareholder value.

Areas to Watch

Content Business Turnaround: Powell's success in improving the performance of the Content segment will be a key area to watch. The sources indicate that this is a priority for SSTK, and Powell's leadership will be critical in achieving those goals.

Balancing Growth and Profitability: It will be interesting to see how Powell manages the trade-offs between investing in high-growth areas like Data and Distribution while maintaining strong profitability in the core Content business.

Integration of Envato: Powell's role in integrating Envato, a recent acquisition, will be important to ensure its success and realize the anticipated synergies.

Overall Impression

Rik Powell appears to be a well-qualified and an experienced executive with a strong background in the industry particularly ready to aid in a successful integration of Envato. His experience as CFO for Getty Images and Shake Shack, coupled with his initial role as SVP & investor relations to SSTK CFO, indicates that he possesses the requisite skills and knowledge to effectively manage the company’s challenges and seize opportunities. His compensation package further aligns his interests with those of shareholders, providing additional motivation to drive growth and profitability.

Financials (highlights)

Revenue Generation:

Revenue Trends: SSTK has consistently grown its revenue over the past few years. The steady increase suggests the company leverages efficiencies to expand offerings while retaining strong customers.

Revenue Sources: SSTK’s revenue comes from selling stock photos, videos, and music to businesses, individuals, and content creators. By diversifying into new markets and introducing innovative products, the company has successfully expanded its revenue streams.

3E - For the FCF multiple, we used a range from 14 to 21 times FCF.

A Speculative nonGAAP EPS Projection for SSTK in 2025: Higher Than Consensus

A reasonable EPS projection for SSTK in 2025 that surpasses the implied consensus of $4.64 /share could be $5 to $6/share. This speculation rests on several key factors and acknowledges inherent uncertainties.

Envato Deal Fuels Continued Content Revenue Growth: Assuming the Envato acquisition surpasses initial expectations, particularly with the unlimited multi-asset subscription model (Envato Elements), we anticipate that SSTK subscribers will stabilize and contribute to the core revenue projections for the content segment. We suggest that Envato’s contribution to SSTK's overall revenue and earnings will be more substantial than initially anticipated. Inclusive of Envato, content revenue is projected to grow by 2.5% throughout the entire year 2024. If momentum persists and the integration of Envato proceeds smoothly, it could provide a substantial boost to content revenue and profitability in 2025. Prior to the Envato deal, SSTK’s subscriber base stood at 470,000, with an average revenue per customer of $446 annually. Envato’s 635,000 subscribers had an average revenue of approximately $85, leaving substantial room for cross-selling revenue growth.

Data, Distribution, and Services Maintain Momentum: The DDS segment has consistently delivered hyper-growth, exceeding expectations in 2024. If SSTK effectively capitalizes on the burgeoning demand for AI training data, expands GIPHY's monetization through partnerships, and continues scaling SSTK Studios, the DDS segment could maintain a strong growth trajectory in 2025. Continued investment in sales talent and strategic partnerships suggests that SSTK is committed to realizing the full potential of this high-growth segment.

Generative AI Integration Enhances Content Value: SSTK is at the forefront of integrating generative AI into its offerings. The launch of SSTK's GenAI 3D capabilities in partnership with NVIDIA, the ImageAI partnership with Databricks, and the observed uptake of AI features by existing and new content customers indicate a successful early adoption of this technology. If this trend continues, generative AI could become a significant tailwind for the Content business, driving customer acquisition, retention, and potentially higher pricing.

Margin Expansion through Operating Leverage and Cost Management: The sources highlight SSTK's commitment to margin expansion. The company has consistently delivered strong adjusted EBITDA margins, reaching 28% in Q2 and Q3 2024. This profitability is driven by a combination of factors, including operating leverage from the high-margin DDS segment, prudent cost management in areas like product development and G&A expenses, and a strategic focus on subscription revenue. If SSTK maintains this discipline, it could lead to further margin expansion and contribute to higher EPS in 2025.

Reaching $5 to $6 EPS in 2025: A Potential Pathway

To illustrate how this speculative EPS figure could be achieved, consider a hypothetical scenario:

Revenue Growth: Assuming a +10% year-over-year revenue growth for 2025 from $913 million run rate, building upon the positive momentum in both Content (driven by Envato and generative AI) and DDS, SSTK's revenue could reach approximately $1.13 billion in 2025.

Adjusted EBITDA Margin: If SSTK maintains its focus on margin expansion and achieves a 30% adjusted EBITDA margin in 2025, this would translate to an adjusted EBITDA of roughly $339 million.

Accounting for Non-GAAP Adjustments: Factoring in potential non-GAAP adjustments, such as stock-based compensation and amortization of intangible assets, which historically have represented approximately 35% of adjusted EBITDA, the resulting non-GAAP EPS could be around $5.50.

Factors and Uncertainties

It is crucial to acknowledge that this projection involves significant amount of speculative projection intent on illustrating a potential scenario and relies on several assumptions. The actual EPS for SSTK 0.00%↑ in 2025 will be influenced by a multitude of factors, including:

The pace and success of integrating Envato and realizing its full growth potential.

The continued momentum and expansion of the Data, Distribution, and Services segment.

The effective integration of generative AI into the Content business and its impact on customer behavior and pricing.

The competitive landscape and the company's ability to maintain market share and pricing power.

Macroeconomic conditions and their impact on customer spending and the overall demand for SSTK's offerings.

Management's ability to effectively execute its strategic initiatives and control costs.

Relative Valuations

Market Capitalization & Enterprise Value - to - Subscriber Comp

Risk Mitigation

Bear Case

Subscribers and rev/subscriber KPIs are steadily declining, and I don’t anticipate this downward trend to reverse. Despite management’s repeated promises of a turnaround in the last quarter, their actions, such as poor pricing and disregard for the impact, contradict these claims. The company’s growth is slowing due to increased competition from AI, $ADBE, and Canva. Moreover, rising costs and pricing competition are putting pressure on margins. Additionally, the company’s valuation is inflated, and its stock price is likely to decline. While we don’t necessarily subscribe to the bear thesis, we believe this presents an opportunity to buy SSTK 0.00%↑.

Key Company Specific Risks & mitigation steps

Monitor Content Business Performance and Competitive Landscape

Content Revenue Trends: Carefully track the performance of SSTK's Content business, which represents the majority of its revenue. While recent quarters have shown sequential revenue improvement, pay attention to the pace of this recovery and the company's ability to return to year-over-year growth.

Envato Integration and Impact: Assess the integration of Envato and its impact on the Content segment's growth and profitability. While early results appear positive, continued monitoring is crucial to understand its long-term contribution.

Competitive Pressures: Stay informed about the competitive landscape, particularly from Adobe (ADBE), which is perceived as the largest significant threat, especially in the enterprise segment. Monitor SSTK's strategies to differentiate its offerings, such as its focus on AI-generated content.

Pricing Trends: Be mindful of pricing pressures in the stock content market, especially in the image segment, which is facing competition from free providers. Evaluate SSTK's ability to maintain pricing power and profitability in this environment.

Assess the Growth and Sustainability of Data, Distribution, and Services

Data Business Visibility: While the Data business is experiencing significant growth, evaluate the sustainability of this momentum. The sources indicate volatility in data revenues and highlight the need for recurring revenue streams.

GIPHY Monetization Progress: Monitor the monetization progress of GIPHY, particularly its ability to secure paying customers beyond Meta. Track metrics like active paying customers, revenue growth, and deal pipeline to assess its long-term potential.

SSTK Studios Performance: Assess the growth trajectory and profitability of SSTK Studios. Evaluate its ability to attract and retain clients, particularly in the competitive production services market.

Sales Force Effectiveness: Evaluate the effectiveness of SSTK's investments in its sales force, particularly in the Data and Distribution segments. Monitor their ability to secure deals, build a strong pipeline, and drive revenue growth.

Evaluate Management's Execution and Strategic Decision-Making

Content Strategy Effectiveness: Pay close attention to management's strategies for reviving the Content business, including product simplification, pricing adjustments, and the integration of AI-generated content. Assess their effectiveness in driving growth and profitability.

Data and Distribution Strategy: Evaluate management's strategic decisions related to data licensing, GIPHY's growth initiatives via app design changes, and SSTK Studios' expansion. Assess their ability to navigate the rapidly evolving landscape and capitalize on emerging opportunities.

Financial Management and Capital Allocation: Monitor the company's financial performance, including profitability, cash flow generation, and capital allocation decisions (dividends, share repurchases, acquisitions). Assess their ability to maintain a strong financial position while investing for growth.

Leadership Transitions: Be aware of leadership changes, such as the recent departure of the CFO. Assess the incoming CFO's experience and their ability to maintain financial discipline and execute the company's growth strategy.

Other Steps

Reduce Concentration Risk: As with any individual stock, avoid overexposure to SSTK. This is a strong conviction idea but has no significant near term hard catalyst identified to close gap between stock price of $30 and the $65 intrinsic value.

Stay Informed: Keep up-to-date on industry trends, regulatory developments, and technological advancements that could impact SSTK's business.

Review Financial Statements: Thoroughly analyze SSTK's financial statements, including its income statement, balance sheet, and cash flow statement. Pay attention to trends in revenue growth, profitability, debt levels, and cash flow generation.

Attend Earnings Calls and Investor Presentations: Listen to SSTK's earnings calls and investor presentations to gain insights into management's perspectives on the business, their strategic priorities, and their outlook for the future.

SSTK's Potential Downfall: A Pre-mortem Analysis

Looking ahead to the next year, the trajectory of SSTK could take a significantly bleak turn if several critical risks materialize and various vulnerabilities converge, potentially causing a substantial decline in the stock price.

Content Business Under Siege: Despite management’s optimism, efforts to revitalize the core Content business may not yield the desired results. Subscriber and revenue-per-subscriber metrics could continue to decline as competition intensifies from both ends of the spectrum. Adobe, with its dominant position in the creative software market, particularly in the enterprise segment, poses a persistent threat. Moreover, free and low-cost platforms like Canva further erode market share by appealing to budget-conscious consumers and small businesses. The anticipated benefits from the Envato acquisition may not materialize, leaving SSTK with a subscriber base significantly lower than the 470,000 subscribers they had before the deal. Consequently, the company has experienced a -26% compounding loss over the past three years of subscribers and faces limited growth prospects.

Data Strategy Unravels: While the Data business holds promise, its long-term success is far from assured. The current hype surrounding AI-generated content could dissipate, resulting in a significant decline in demand for training data. Deal sizes may shrink, and the lucrative upfront revenue streams that SSTK has enjoyed could vanish. As revenue growth is considered lumpy, we may be deceived into believing that next year will be better, but the industry’s demand for such businesses is actually declining. Furthermore, as the market matures, competition will likely intensify, leading to price reductions and squeezing margins.

Financial Fragility Exposed: SSTK’s financial health could deteriorate further in a worst-case scenario. The aggressive acquisition strategy, while driving top-line growth, has come at the cost of increased debt and potential dilution through stock-based compensation. If revenue growth falters, the company may be forced to cut costs, potentially impacting content quality and further alienating contributors, who have already experienced revenue share reductions. This vicious cycle could ultimately lead to a downward spiral in both financial performance and stock price.

Management Credibility Wanes: Skepticism towards management’s pronouncements stems from overly optimistic projections and a perceived lack of transparency about the company’s underlying performance. This skepticism is further intensified by insider selling, which signals a lack of confidence in the company’s future prospects. In the most severe scenario, this erosion of trust could lead to a decline in investor confidence, posing a significant challenge for SSTK to raise capital or pursue strategic initiatives.

Market Sentiment Turns Bearish: The confluence of these negative factors could trigger a broad-based sell-off in SSTK’s stock. The current low valuation multiple, while seemingly attractive, may not provide a sufficient margin of safety. As investors re-evaluate the company's prospects, the stock could fall prey to multiple contraction, further exacerbating the decline. The target price of $18 to $23 per share, representing a 40% downside from the current price, underscores the severity of this potential scenario.

This pre-mortem analysis paints a stark picture of the potential risks facing SSTK 0.00%↑ over the next year. It is important to note that this is a hypothetical worst-case scenario, and the actual outcome may be different. However, by acknowledging these vulnerabilities, investors can better assess the potential downside risk and make more informed investment decisions.