SUMMARY

At current prices, I recommend opening bullish trading/investing strategies on DXC Technology Inc. (DXC) because my views suggest that future cash profitability will likely normalize towards its higher margin Global Business Services (GBS) segment, as the company seizes additional market share by FY2025. DXC’s more capital intensive Global Information Services segment will provide near term cash support as management right sizes into a leaner organization through asset sales (aka portfolio shaping/cost optimization initiatives) and leverage the bottom half of its Information Technology (IT) stack of services into cross-selling and up-selling value-add services with current clients. This is not to also miss out on the growth potential tailwind for the IT services industry estimated to be higher than overall world GDP growth over the next decade and in certain sub segment pockets which DXC operates 20% to +30% growth potential is projected by industry professionals.

My overall view about the IT services industry’s revenue growth potential which DXC operates compels me to anticipate a normalized earnings forecast for 2025 in the range of $7.30 to $8.12, which puts me +37% higher than consensus 2025 nonGAAP earnings forecast of $5.31.

Under my scenario-weighted expectations, applying a 14.1x multiple on the $6.78 weighted normalized earnings for 2025, results in a 3-year price target of ~$95+, which is a 54% compounded annual growth rate (cagr) above the August 25, 2022 $25.57 close.

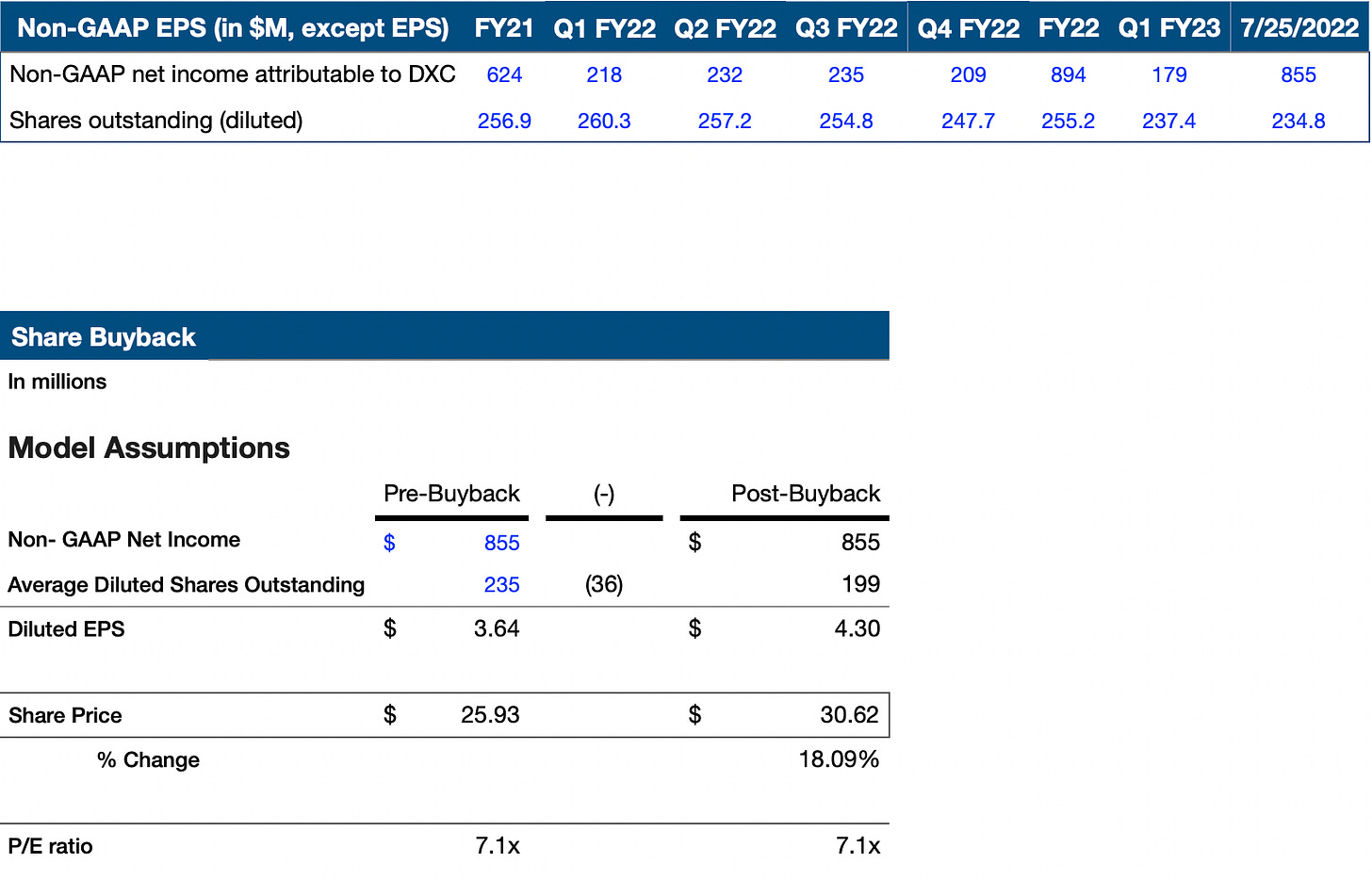

My above-consensus estimate is based on my analysis of share buybacks assuming available cash on hand builds to allow management to buy in excess +15% of fully diluted shares which should bring the share count down to 200 million fully diluted outstanding shares. Currently, management is closing a sale of it German financial services subsidiary which will free up nearly $700 million dollars of required cash. This would bring their $2.5 billion cash level down to $1.8 billion of required cash.

Management has additionally earmarked roughly $500 million of cost expected to be eliminated in the below areas:

– Staff optimization including increasing productivity and offshoring

– Contractor conversion

– Office and Data Center space

– Network and Telecommunications

– 3rd party spend in the areas of hardware and software.

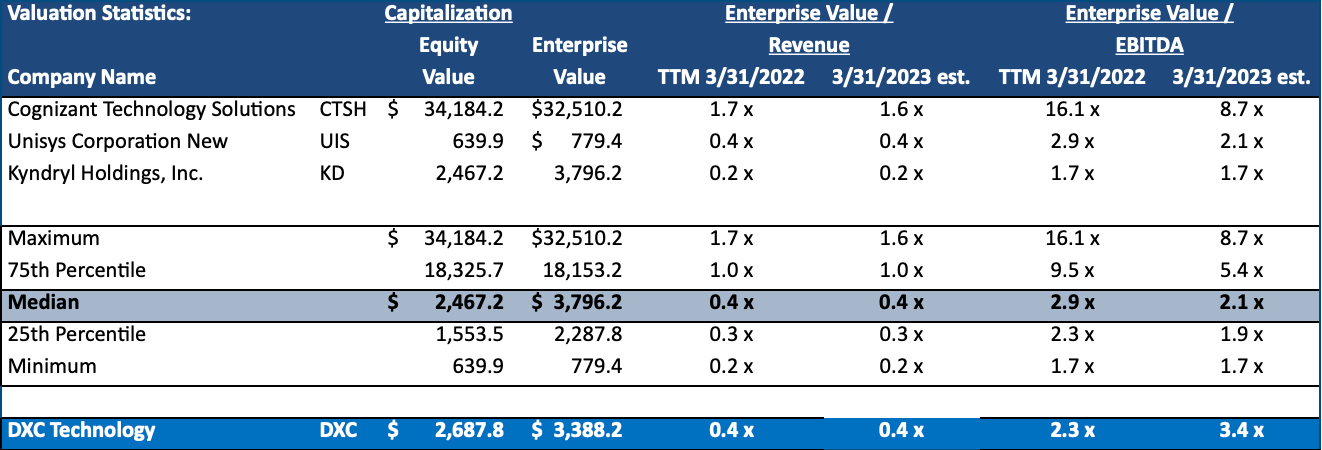

When you consider another $500 million in asset sales most likely from DXC’s GIS segment, it leaves management roughly $2.4 billion in FY 2023 (March 2022 to March 2023) to return capital to shareholders in the form of the more efficient share buybacks but possibly a reinstitution of dividends as consensus is expecting. The below table reflects peer comps for DXC’s GIS segment in terms of what an asset sale cash proceeds could provide. Management thoughts regard asset sales has been clear as stated on earnings calls.

~ CEO Mike Salvino on the DXC 1st quarter 2023 earnings call

For dividends, $.80 to $1 per share would be a likely scenario and a significantly large dutch tender offer execution for 30 million shares would be catalyzing for stock price appreciation otherwise annual buybacks of 8% of the outstanding diluted shares would produce incremental stock appreciation albeit at a slower pace. The usual fake “hey we are thinking about buying back stock” management announcements would pose a significant risk as the market has caught on to such falsehoods.

Operationally, DXC is fast approaching management’s “high optempo” of efficiency. Converting contractors to employees as well as rebuilding from capital intensive in the office work environment to its own virtual workplace employee model which is less capital intensive and more incentivizing. I would expect this builds on the customer experience vastly improving retention and winning additional business as DXC converts customer into clients and from a transactional business model towards a relational buildout creating a significant competitive advantage by way of client’s purchasing agents mindshare when they think of IT servicing needs.

I believe, in aggregate, market participants don’t appreciate the future high growth company story that is ahead for DXC over the next decade. Consensus thinking seems to be anchored into the declining revenue storyline that DXC has proven over the past 5 years. The initial spinoff merger that created DXC on April 1, 2017 was essentially the Titanic with golden bells rolled out with extravagance; it failed. DXC has sold off assets and spun businesses as if to be undergoing a self liquidation and watched $11 billion in revenue evaporate from its $26 billion high. It's hard not to sympathize for shareholders or potential shareholders to be distrustful of the story current management has been telling. On the outset it is simple; value was destroyed.

Company Overview

Keep reading with a 7-day free trial

Subscribe to The Genius’s Stock Market Newsletter to keep reading this post and get 7 days of free access to the full post archives.