CytomX Therapeutics, Inc.($CTMX)

High Capital Efficiency, Uncertain Earnings for Value Traders?

While CytomX Therapeutics, Inc. (CTMX 0.00%↑) initially caught my attention due to its promising financial metrics, a deeper dive reveals some concerns for value traders. Here are some of my notes and thoughts worked out:

Promising Tech, Unpredictable EPS:

Despite a relatively strong asset base of $157 million and near-term operating liabilities of $138 million, the company's EBITDA of $8 million indicates a high capital efficiency. However, this apparent strength is tempered by the underlying uncertainty of the company's earnings generation. The reliability of these earnings, particularly in the context of a biotech company, may be less predictable, limiting the potential for a sustainable competitive advantage.

About CytomX Therapeutics:

Founded in February 2008 (previously CytomX LLC)

Located in South San Francisco, California (website: https://cytomx.com)

Clinical-stage oncology biopharma company

We commenced operations in February 2008 when our predecessor entity, CytomX LLC, was formed. We were incorporated in Delaware in September 2010. Our principal executive offices are located at 151 Oyster Point Blvd., Suite 400, South San Francisco, California 94080, and our telephone number is (650) 515-3185. Our website address is https://cytomx.com.

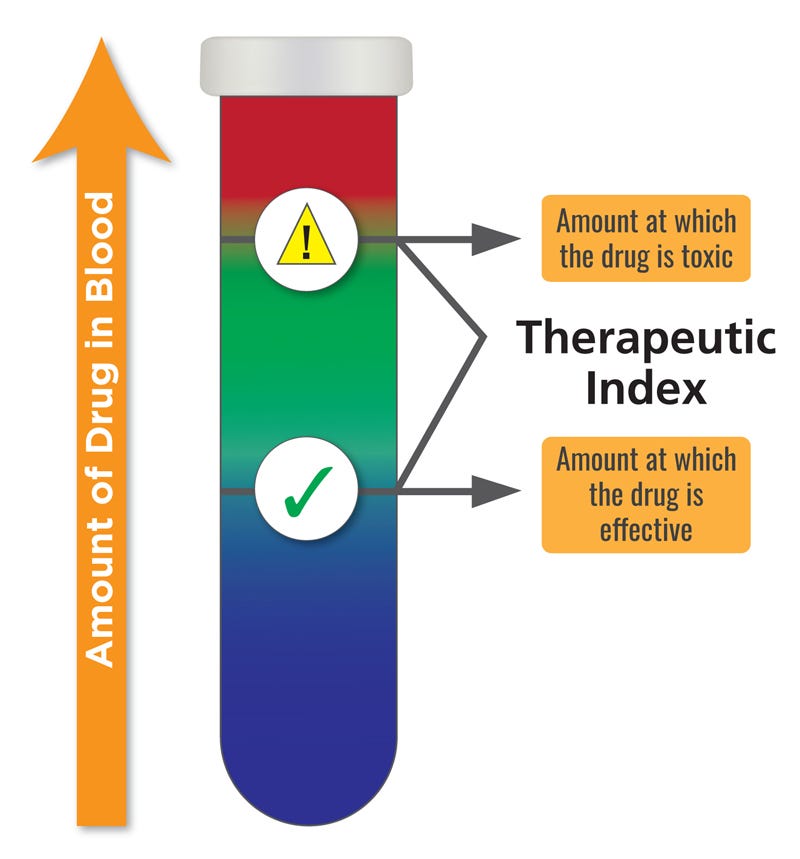

CTMX 0.00%↑ is a clinical-stage oncological biopharma company focused on developing novel, conditionally activated, masked biologics for treatment. Their PROBODY® therapeutic technology platform enables conditional activation of potent biologic therapeutic candidates within the tumor microenvironment, while minimizing drug activity in healthy tissues and circulation. CTMX 0.00%↑ is leveraging their platform to address challenges in oncology biologics research and development, such as validating potential new targets for Antibody-drug conjugates (ADCs), opening therapeutic windows for Trichloroethylene (TCEs) targeting solid tumors, and increasing the therapeutic index for immune modulators. Their pipeline includes clinical-stage molecules CX-904, CX-2051, and CX-801, which address targets or mechanisms that have been previously validated as having anti-cancer activity but have been limited in their utilization due to systemic toxicities.

TCE = Trichloroethylene (TCE) is a volatile, colorless liquid organic chemical.

Clinical Trial Stages for Oncology Companies and Success Rates

Understanding the Long Rocky Road to Market

The development of a new oncology drug typically involves multiple stages of clinical trials. Each stage has a specific goal and success rate, with the overall success rate decreasing as trials progress. Here's a breakdown:

Preclinical Stage

Goal: Evaluate the drug's safety and efficacy in animals.

Success Rate: Approximately 10-20% of drugs tested in animals proceed to clinical trials.

Phase I

Goal: Assess safety and tolerability in healthy human volunteers.

Success Rate: Around 60-70% of drugs that enter Phase I proceed to Phase II.

Phase II

Goal: Evaluate efficacy and safety in patients with the target disease.

Success Rate: Approximately 30-40% of drugs that enter Phase II progress to Phase III.

Phase III

Goal: Confirm efficacy and safety in a larger group of patients.

Success Rate: Roughly 10-20% of drugs that enter Phase III are approved by regulatory agencies.

New Drug Application (NDA) Submission and Review

Goal: Submit the drug's development data to regulatory agencies for approval.

Success Rate: The approval rate varies depending on the regulatory agency and the specific drug, but it's generally around 50-60%.

Post-Approval Surveillance

Goal: Monitor the drug's safety and efficacy after it's on the market.

Success Rate: Not applicable; this is a continuous process to ensure the drug's safety and effectiveness.

Overall Success Rate: The overall success rate of a drug progressing from preclinical development to market approval is typically less than 10%. This low rate reflects the challenges associated with developing effective and safe oncology treatments.

Is CTMX in a Value Traders Portfolio?

Getting to NO Quickly

CytomX's technology has promise. But the inherent uncertainty in the biotech industry due to the low success rate of oncology drug development and the long development timeline for new drugs make it a less attractive. Searching for probability weighted predictable genius-like returns requires turning over a lot of rocks and under this one it isn’t it!!!