A Tire Manufacturer's Unusal Earning season

GOODYEAR TIRE🛞 & RUBBER CO

This is a quick analysis and more of an interpretation/reading of the tea leaves of market dynamics to assess the potential value trade in Goodyear Tire & Rubber Co. (GT 0.00%↑). I’ve been diligently following GT for about a year now, but understanding its underlying fundamentals has been challenging. It’s difficult to comprehend why the company’s fundamentals suggest that the stock’s current price of $8 could be higher.

Recently, there have been signals in the earnings of industry-adjacent companies, insider compensation, and to a lesser extent, the disclosure of 13G by a new large individual smart money investor. For reference, a three-month trading chart of GT is included below:

Company Description

Goodyear Tire & Rubber Company, a tire manufacturer with over 80% of its revenue coming from tire sales, offers a range of tire lines under various brands, including Goodyear, Cooper, Dunlop, Kelly, Mastercraft, Roadmaster, Debica, Sava, Fulda, Mickey Thompson, Avon, and Remington. Beyond tire sales, the company provides retread tires, tread rubber, and other tire retreading materials, chemical products, automotive repair services, and a variety of miscellaneous products and services.

With a network of approximately 1200 retail outlets and a robust online presence, Goodyear sells its products and installation services. The company also offers automotive maintenance and repair services under the Goodyear and Just Tires names, selling automotive repair and maintenance items, automotive equipment, and accessories to dealers and consumers.

Founded in 1898 and headquartered in Akron, Ohio, Goodyear has a long history spanning over a century. The company is looking to the future of mobility, investing in tire technology that prioritizes safety, efficiency, and performance, particularly in the areas of electric vehicles, autonomous driving, and connected mobility.

As of October 2023, Goodyear Tire & Rubber Company holds a global market share of 15% in the tire industry, both in terms of units and dollars, while in the US, with an estimated 32.4% of the total industry revenue.

Industry

Industry growth drivers:

Increasing demand for vehicles: As the global economy continues to grow, so too does the demand for vehicles.This is particularly true in emerging markets such as China and India.

Replacement demand: Tires are a consumable product, and as vehicles age, they need to be replaced. This is expected to drive demand for replacement tires in the coming years.

Specialty applications: There is growing demand for tires for specialty applications such as motorcycles, high-performance vehicles, and off-the-road (OTR) equipment.

But More about the Signals

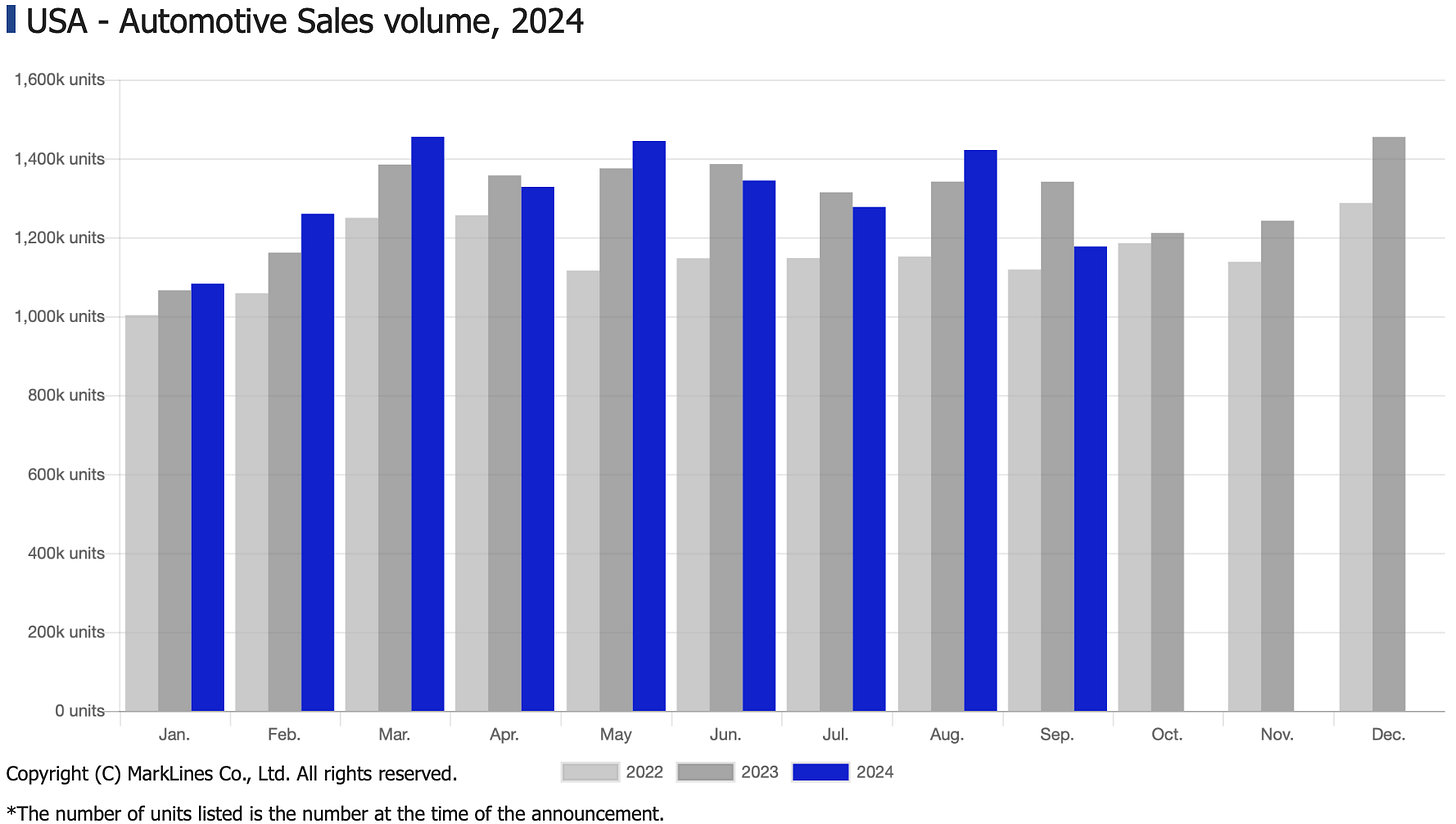

I anticipate positive expectations for Q4 2024 tire sale market due to an uptick in used cars over the next 3 months👇🏾 despite a possible miss with GT reporting end of day today.

Incentive Compensation & Insider Buys

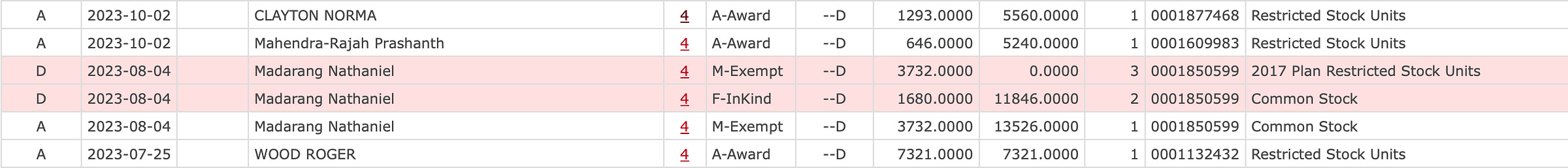

This signal is on the recent compensation award significantly increased over last year along with insider buying activity

Resources:

https://www.tirebusiness.com/mid-year-report

Value Trade Setup

Likely worth putting my own funds into being long the stock

Keep reading with a 7-day free trial

Subscribe to The Genius’s Stock Market Newsletter to keep reading this post and get 7 days of free access to the full post archives.