A Thruple M&A Potentially Blown Down. Piggly's Parent Awaiting

My tentative notes on the Kroger's Acquisition of Albertsons as C&S Await.

TL;DR

🛒 KR 0.00%↑ and 🛒 ACI 0.00%↑ are teaming up to create a grocery behemoth! 🤯 This merger could shake up the grocery industry, impacting prices and product availability. 💰

C&S Wholesale is also in the mix, taking over some Albertsons stores, especially those overlapping with Kroger's locations. 🔄 This could lead to more competition and potentially lower prices in certain areas. SO THEY SAY

But wait... there's a catch! ⚠️ The antitrust case against this merger is heating up, and it might end up in the Supreme Court. ⚖️ The outcome could hinge on the next president, making this a highly speculative situation. 👀

Let’s discuss! What do you think about this merger? Will it benefit consumers? Share your thoughts in the comments below! 👇

Who

Krogers🛒🍎🏠 The Acquirer

The Kroger Company KR 0.00%↑, bka Krogers, is an 🇺🇸American grocery retailer operating supermarkets, multi-department stores, and fulfillment centers throughout the U.S. These operations account for approximately 97% of the company. Trailing twelve month revenue is $150.14 Billion or $206.32 per share w/ ~728 million full diluted shares outstanding (FDSO)..To ensure responsiveness to local needs and effective execution of strategic initiatives, Krogers operating divisions are primarily organized on a geographical basis.

As of February 3, 2024, KR 0.00%↑ operated 2,722 supermarkets, including 2,257 with pharmacies and 1,665 with fuel centers, across 35 states and the District of Columbia. Half of the supermarkets are housed in company-owned facilities, with some located in company-owned buildings on leased land.

Krogers employs various banner names to derive brand recognition in communities they serve. KR 0.00%↑ incorporates fuel centers at its supermarket locations whenever feasible and profitable, typically offering five to ten fuel dispenser islands with storage capacity ranging from 40,000 to 50,000 gallons.

Their supermarket footprint generally falls into one of 🔢 formats: 📕combination food and drug stores (combo stores), 📗multi-department stores, 📘marketplace stores, or 📙price impact warehouses. The primary format is the combo store. KR 0.00%↑ store layout is designed with specialty departments in mind, including natural food and organic sections, pharmacies, general merchandise, pet centers, and high-quality perishables.

Multi-department stores, are larger than the combo stores but offer an expanded range of general merchandise items such as apparel, home fashion and furnishings, outdoor living, electronics, automotive products, and toys. The marketplace stores are smaller than multi-department stores. They do provide the full-service grocery store experience. With pharmacy, health and beauty care departments, along with an expanded perishable offering and a general merchandise area.

Albertsons🛒🍎🏠 - The Target

Albertsons Companies ACI 0.00%↑, Inc., bka Abertsons, a food and drug retailer in the United States, operates stores under various banners such as Albertsons, Safeway, Vons, Jewel-Osco, Shaw's, Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star Market, Haggen, Carrs, Kings Food Markets, and Balducci's Food Lovers Market.

C&S Wholesale Grocer 🚚📦🏭 - The Vulture

C&S Wholesale Grocers is a large wholesale grocery supply company in the U.S., currently run by Rick Cohen, as owner and executive chair. 👪 C&S has been family-owned since its founding with Israel Cohen and Abraham Siegel. Rick is third generation to Israel Cohen

C&S has recently faced scrutiny due to its connection to Symbotic Inc., a company also led by Rick Cohen. Symbotic has been accused of misleading investors regarding its growth potential and business model. These allegations have raised concerns about potential conflicts of interest and the impact on both companies. Here is a short thesis by an anonymous poster

C&S runs a network of distribution centers in connection to a network of retailers. C&S has to navigate a number of questions & complexities in order to fulfill the promise of the KR 0.00%↑ divestiture plan without falling into peril as is expected. Seeing C&S navigate the web it has coming its way will be interesting to see. How will the company evolve? How will they weather to maintain its reputation as a trusted and reliable partner to the grocery industry?

Federal Trade Commission (FTC)⚖️🏛️ 🗣️👁️ - The Plaintiff

The FTC, an independent U.S. government agency, plays a role in consumer safeguard and attempt to ensure free enterprise competition. The October 2022 news of the proposed merger between Kroger and Albertsons drew attention to the FTC after lawmakers and serval industry interest groups made certain alleged implications

The FTC's primary concern is that a merger between two of the largest grocery chains in the United States could lead to reduced competition. This, in turn, could result in higher prices for consumers, a decline in product quality, and a reduction in innovation.

To assess the potential impact of the merger, the FTC examinesI factors such as market share, geographic overlap, and the likelihood of anti-competitive behavior. The FTC may also seek input from consumers, suppliers, and other interested parties.

If the FTC determines that the merger poses a threat to competition, it has the authority to block the deal. However, the agency may also negotiate with the companies involved to secure concessions that address its concerns. These concessions could include divestitures of certain stores or assets, or commitments to maintain competitive pricing and product selection. The outcome will have huge implications for the industry and consumers; good or bad.

Various U.S. States

Infavor of the Merger

Ohio Attorney General Dave Yost Asks Court to Scrap FTC Holdup of Kroger-Albertsons Merger

Ohio, Alabama, Georgia and Iowa Amicus Brief filed with Portland, Oregon U.S. District Court

Against Kroger-Albertson Merger

States of: Arizona, California, Illinois, Maryland, Nevada, New Mexico, Oregon, Wyoming, and the District of Columbia

Out of all those involved who’s the wolf & who are the fat piglets?

What

Albertson termination fee is a cash amount equal to $318,000,000.

Krogers termination fee a cash amount equal to $600,000,000.

Assessing U.S. Administrative State Political Agenda

FTC considers “Kroger and Albertsons as the #1 and #2 traditional supermarket chain in the United States with a combined footprint approximately 5,000 stores, 4,000 retail pharmacies, and 700,000 employees across 48 states” per the FTC.

Proposed merger: A combination of Kroger and Albertsons, creating one of the largest grocery chains in the United States.

Divestiture: Sale of certain stores to C&S Wholesale Grocers to address antitrust concerns.

Litigation: Legal challenges brought by the FTC and various states against the merger.

I believe political considerations are outweighing regulatory concerns. Krogers and Albertsons have enough overlap in the business model to integrate their operations. This would likely have cause for concern under the current incumbent presidential administrations. The story is being written as Goliath vs the people.

When

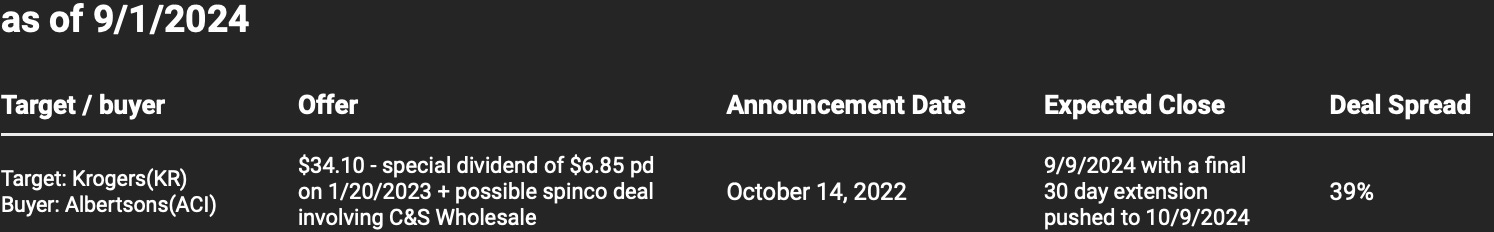

Merger Announcement: made in October 2022.

Divestiture plan: The initial divestiture plan was announced in September 2023.

Kroger, Albertsons, C&S Divestiture Postponed

Litigation: The FTC filed a lawsuit to block the merger was February 2024.

Deal termination: Initial date was January 13, 2024 w/ allowances of multi 30-day extension periods not to exceed 270 day or October 9, 2024 as the last day.

Where

KR 0.00%↑ is an American grocery company headquartered in Cincinnati, Ohio

ACI 0.00%↑ is also an American grocery company headquartered in Boise, Idaho.

C&S is headquartered in Keene, New Hampshire.

U.S. District Court litigation in Portland, Oregon

Why

Economic benefits: Kroger and Albertsons believe the merger will lead to lower prices for consumers, increased investments in stores and communities, and more opportunities for employees.

Antitrust concerns: The FTC and several states argue that the merger could reduce competition, leading to higher prices for consumers.

Why do Kroger and Albertsons want to merge?

Kroger and Albertsons — two of the largest grocery chains in the U.S. — announced in October 2022 that they planned to merge. The companies say the $24.6 billion deal would hold down prices by giving them more leverage with suppliers and allowing them to combine their store brands. They say a merger also would help them compete with big rivals like Walmart, which now controls around 22% of U.S. grocery sales. Combined, Kroger and Albertsons would control around 13%.

Why does the FTC want to block the merger?

Antitrust regulators say the proposed merger would eliminate competition, leading to higher prices, poorer quality and lower wages and benefits for workers. In February, the FTC issued a complaint seeking to block the merger before an administrative judge at the FTC. At the same time, the FTC filed the lawsuit in federal court in Oregon seeking the preliminary injunction. The attorneys general of Arizona, California, the District of Columbia, Illinois, Maryland, Nevada, New Mexico, Oregon and Wyoming all joined the federal lawsuit.

How

Divestiture: Kroger and Albertsons agreed to sell a significant number of stores to C&S Wholesale Grocers to address antitrust concerns.

Litigation: The FTC and various states are challenging the merger in court, arguing that the divestiture plan is insufficient to prevent anticompetitive harm.

References & Further Reading

October 14, 2022 - Kroger and Albertsons Companies Announce Definitive Merger Agreement

Kroger Company/Albertsons Companies, Inc., In the Matter of

Website Dedicated to Kroger’s proposed merger with Albertsons /likely to become a bad link once deal is cmplt’d or terminated

more continued👇🏾👇🏾

Trade/Investment Approach: Highly Risky

1. Opening bullish long KR 0.00%↑ & ACI 0.00%↑ underlying. Given expections of deal failure.

Downside is already priced in since the high deal spread seems to bake in deal closure NOT likely to close as the FTC has already made a decision from in-house judges. Scaling an almost 5 year graph of KR 0.00%↑ and its trading pattern there is support for the stock to trade down to a range of $42 to $44 considering the merger announcement was on October 2022. In most M&A, if the acquirer is publicly traded, KR 0.00%↑ in this case you would see the stock trade lower and the target, ACI 0.00%↑ get a deal jump. I believe deal failure would easily see KR 0.00%↑ stock jump past analyst consensus above $58 to close by year end or the first week of $65 or a +25% gain. There is a lot of room for year end window dressing to top tear grocery company trading at low multiples and high returns. Both near term and long term owners can expect to do very well by owning the stock IMO.

2. Opening bullish long KR 0.00%↑ derivative strategies expecting the deal to fail

Keep reading with a 7-day free trial

Subscribe to The Genius’s Stock Market Newsletter to keep reading this post and get 7 days of free access to the full post archives.